Hello Caton Team Friends,

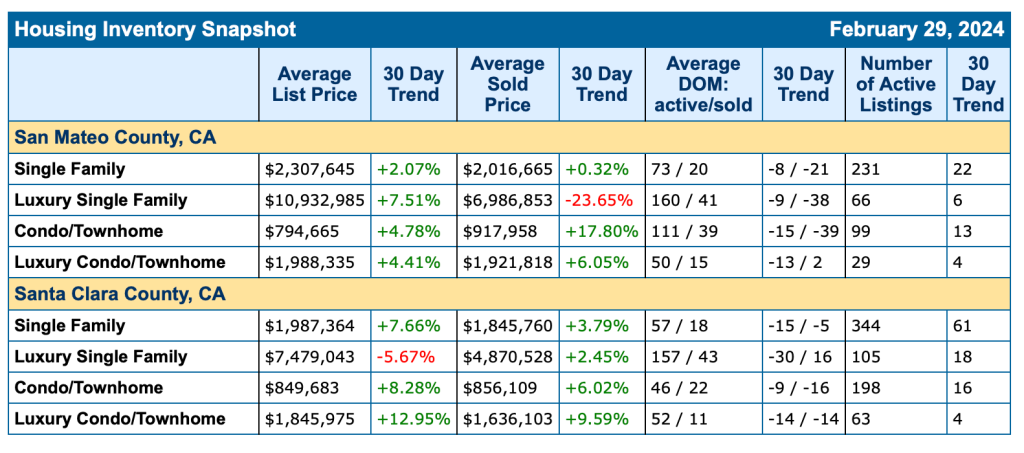

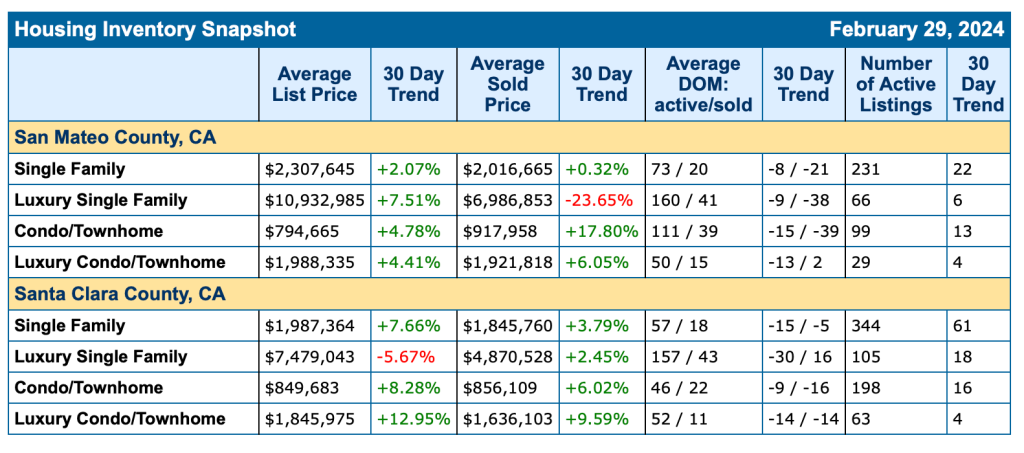

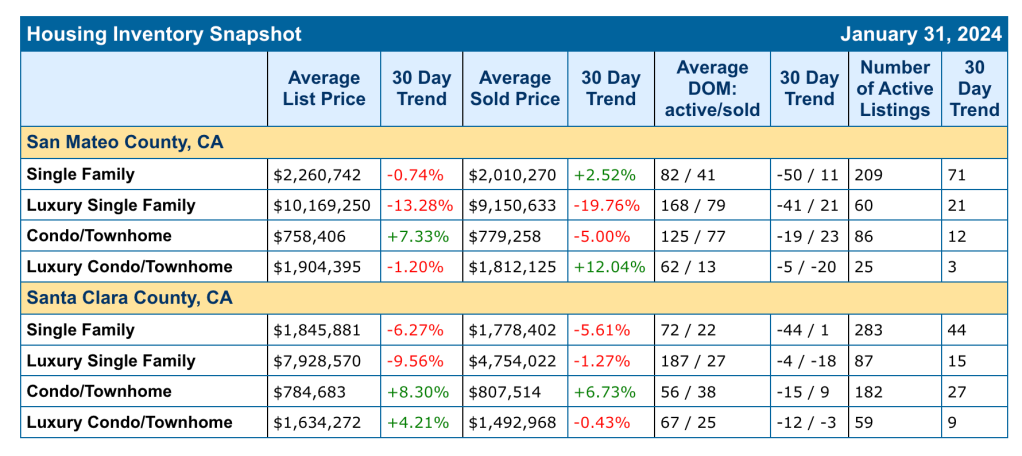

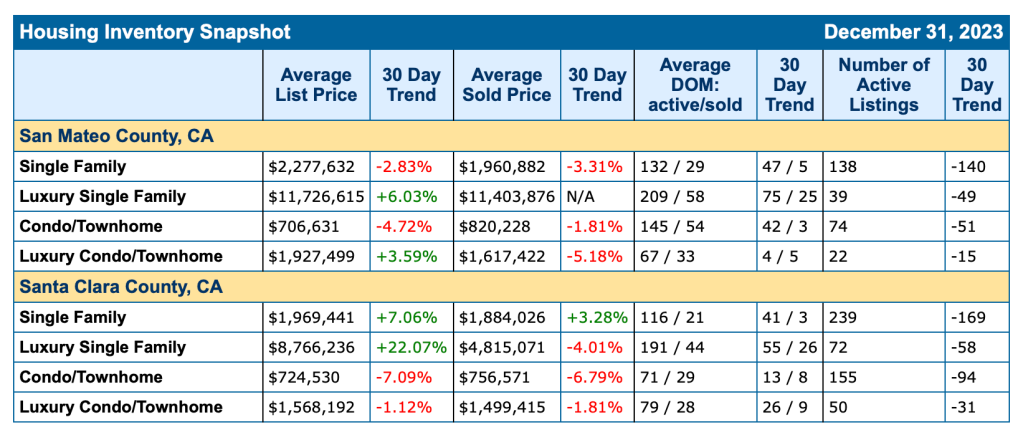

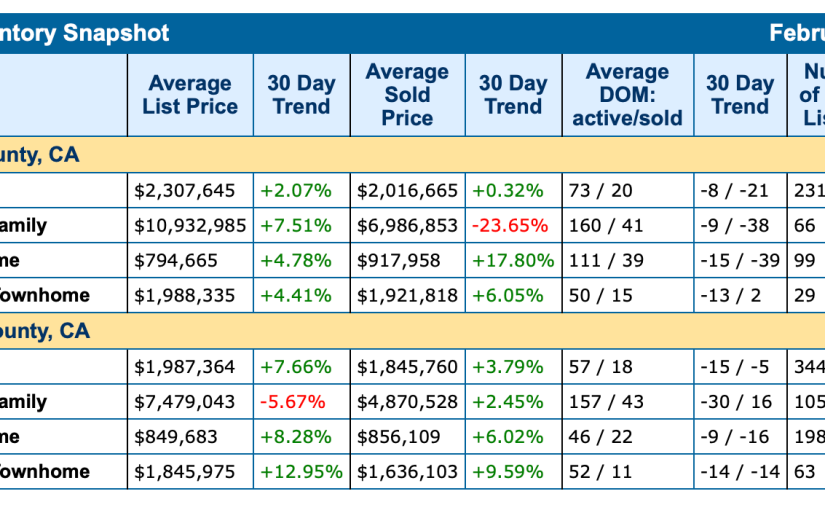

Here’s the latest stats! Sales are UP from January! It is amazing to see the seasonal changes in Real Estate. We expect a healthy Spring Market and we’re starting to see new properties come on the market.

Need help navigating this market? We’re happy to be of service. Reach out 650.766.4333 | Info@TheCatonTeam.com

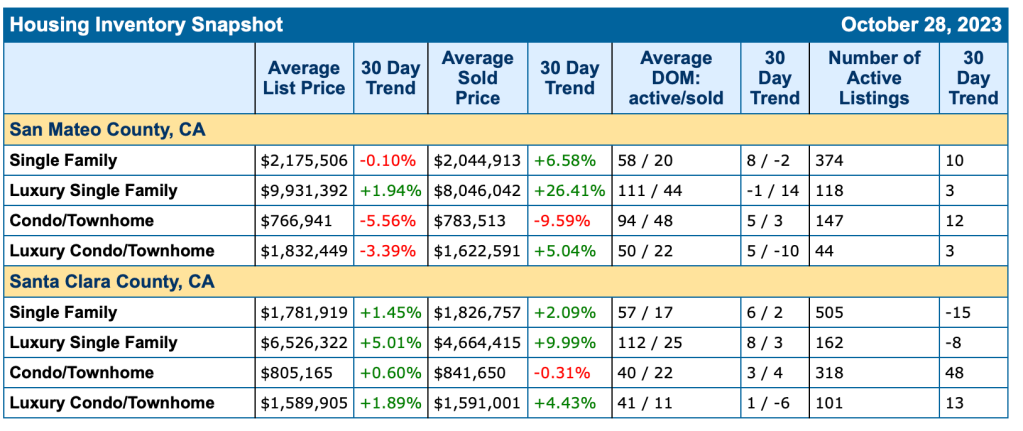

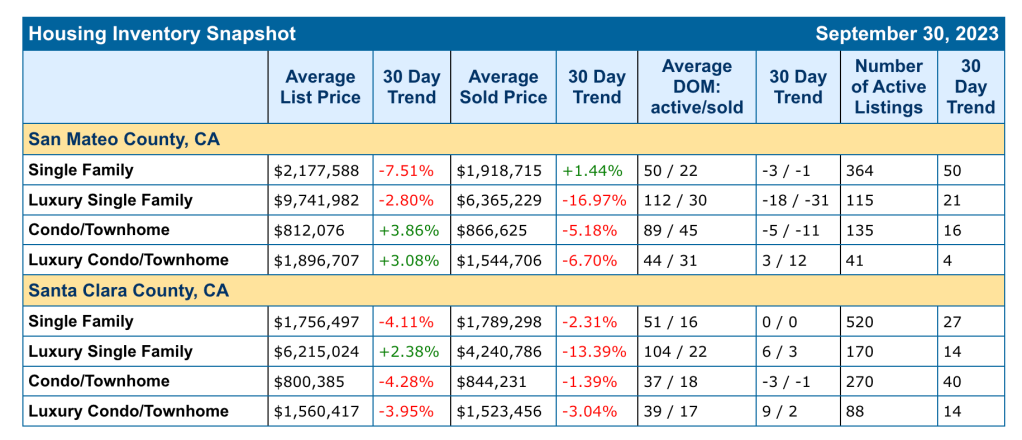

Here’s a look at the month over month trend…

How can The Caton Team Help You?

Contact The Caton Team 650.799.4333 | Email Info@TheCatonTeam.com

Whether you are selling or buying – today or tomorrow – contact The Caton Team – we’re happy to help you achieve your Real Estate goals.

Effective. Efficient. Responsive. The Caton Team 🏡

Each market is unique and with over 40 years of combined Real Estate experience, The Caton Team is more than happy to be of service if and when you are considering a move. Contact us anytime during your journey, together we’ll help you achieve your Real Estate goals.

Got Questions? The Caton Team is here to help.

Call | Text | Sabrina 650.799.4333 | EMAIL | WEB | BLOG

We love what we do and would love to help you navigate your sale or purchase of Residential Real Estate. Please reach out for a personal consultation. Please enjoy our free resources below and get to know our team TESTIMONIALS.

| HOW TO SELL | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TESTIMONIALS |

Get exclusive inside access when you follow us on Facebook & Instagram

| HOW TO SELL | GET READY CAPITAL – Loans to Prep for Sale | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TESTIMONIALS |

Got Real Estate Questions? The Caton Team is here to help.

We strive to be more than just Realtors – we are also your home resource. If you have any real estate questions, concerns, need a referral, or need some guidance – we are here for you. Contact us at your convenience – we are but a call, text or click away!

The Caton Team believes, in order to be successful in the San Fransisco | Peninsula | Bay Area | Silicon Valley Real Estate Market we have to think and act differently. We do this by positioning our clients in the strongest light, representing them with the utmost integrity, while strategically maneuvering through negotiations and contracts. Together we make dreams come true.

A mother and daughter-in-law team with over 35 years of combined, local Real Estate experience and knowledge – wouldn’t you like The Caton Team to represent you? Let us know how we can be of service. Contact us any time.

Call | Text | Sabrina 650.799.4333 | Susan 650.796.0654 |EMAIL | WEB| BLOG

The Caton Team – Susan & Sabrina

A Family of Realtors

Effective. Efficient. Responsive.

What can we do for you?

The Caton Team Testimonials | Blog – The Real Estate Beat | TheCatonTeam.com | Facebook | Instagram | HomeSnap | Pinterest | LinkedIn Sabrina

Berkshire Hathaway HomeServices – Drysdale Properties

DRE # |Sabrina 01413526 | Susan 01238225 | Team 70000218 |Office 01499008

The Caton Team does not receive compensation for any posts. Information is deemed reliable but not guaranteed. Third-party information not verified.

You must be logged in to post a comment.