Once you decide to sell your home, you might have questions about how to prepare it for listing and viewing by potential buyers. Here are some common considerations as you prepare your home to sell:

How do I find the right agent to sell my home?

You should feel empowered to find and work with the agent who is the best fit for your needs. To guide this process, NAR has a dedicated resource with questions to consider when selecting a seller’s agent. When you work with an agent who is a REALTOR®, you are working with a professional guided by ethical duties under the REALTOR® Code of Ethics, including the pledge to protect and promote the interests of their clients. The Caton Team are proud to be Realtors!

Do I need to have my home inspected before putting it up for sale?

No, a pre-sale inspection is not required, but here in the Bay Area is to preferred.* However, an inspection can be used to identify potential issues in your home that you can consider repairing before showing your home to potential buyers and use as a differentiator for your property. If you choose to conduct a pre-sale inspection, an inspector will assess your home’s condition, including its structure, exterior, roof, plumbing, electrical systems, heating and air conditioning, interiors, ventilation / insulation, and fireplaces. It may also include tests for problems that can affect human health like mold, radon gas, lead paint, and asbestos. Sometimes buyers may also conduct their own inspection as a contingency in their purchase agreement. If you uncover possible issues that may appear during a buyer’s inspection, you will have time to make any necessary changes that could impact your home’s asking price. You should also talk to your agent about disclosure requirements in your state if a pre-sale inspection uncovers an issue.

What should I do if something in my home needs to be fixed or replaced soon?

If something in your home requires a significant repair—such as a roof, a system such as HVAC, or an appliance like a dishwasher or washer / dryer—you should determine how much the repair will cost, even if you do not plan to fix it before selling the home. These estimates will help sellers determine the costs that buyers might take into consideration when negotiating a purchase agreement.

Am I required to make any cosmetic updates to my home before putting it up for sale?

No, but you may want to clean the windows, carpets, lighting fixtures, and walls, and store away clutter before showing your home to potential buyers. Sellers may also look for ways to improve “curb appeal”—how the home looks to a potential buyer when viewed from the street—by updating aspects such as landscaping, the front entrance, and paint jobs. These steps may help improve the home’s appearance in photos, which can play an important role in attracting potential buyers.

Do I need to provide information about appliances that will stay in the home after it’s sold?

You should locate warranties, guarantees, and user manuals for the furnace, washer / dryer, dishwasher, and any other appliances or systems that will stay in the house with a new buyer. It is recommended that you find these items now to avoid any lost paperwork causing an issue with a potential buyer when you reach the time of finalizing, or “closing,” the transaction.

What does it mean to stage my home?

Staging is the process of cleaning a home and temporarily filling it with furniture and decorations that may help buyers better see themselves living in the home. While it is not required, some sellers may work with a stager to focus on certain key areas of their home that are important to buyers. Some agents may also include staging in the services they provide you.

I read this article HERE.

Got Questions? The Caton Team is here to help.

Cell| Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB | BLOG

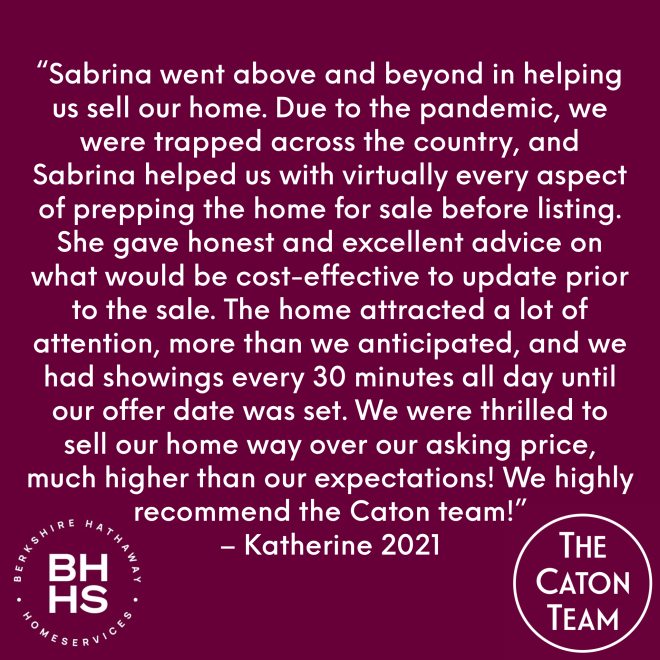

We love what we do and would love to help you navigate your sale or purchase of Residential Real Estate. Please reach out for a personal consultation. Please enjoy our free resources below and get to know our team from our TESTIMONIALS.

Effective. Efficient. Responsive. The Caton Team 🏡

How can The Caton Team help You?

TESTIMONIALS | HOW TO SELL | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TRUST AGREEMENTS | HEALTH CARE DIRECTIVES | TESTIMONIALS

Get exclusive inside access when you follow us on Facebook & Instagram

TESTIMONIALS | HOW TO SELL | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TRUST AGREEMENTS | HEALTH CARE DIRECTIVES | TESTIMONIALS

Got Real Estate Questions? The Caton Team is here to help.

We strive to be more than just Realtors – we are also your home resource. If you have any real estate questions, concerns, need a referral, or some guidance – we are here for you. Contact us at your convenience – we are but a call, text or click away!

The Caton Team believes, in order to be successful in the San Fransisco | Peninsula | Bay Area | Silicon Valley Real Estate Market we have to think and act differently. We do this by positioning our clients in the strongest light, representing them with the utmost integrity, while strategically maneuvering through negotiations and contracts. Together we make dreams come true.

A mother and daughter-in-law team with over 35 years of combined, local Real Estate experience and knowledge – wouldn’t you like The Caton Team to represent you? Let us know how we can be of service. Contact us any time.

Cell | Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB| BLOG

The Caton Team – Susan & Sabrina

A Family of Realtors

Effective. Efficient. Responsive.

What can we do for you?

Website | The Caton Team Testimonials | Our Blog – The Real Estate Beat | Search for Homes | Facebook | Instagram | HomeSnap | Pinterest | LinkedIn Sabrina | Photography | Photography Blog

Berkshire Hathaway HomeServices – Drysdale Properties, Redwood City Ca.

DRE # | Sabrina 01413526 | Susan 01238225 | Team 70000218 | Office 01499008

The Caton Team does not receive compensation for any posts. Information is deemed reliable but not guaranteed. Third-party information not verified.

You must be logged in to post a comment.