Buying a home is a powerful decision, and it remains at the heart of the American Dream. Unlike renting, owning a home means more than just having a place to live – it offers a sense of belonging, stability, and freedom. According to Nicole Bachaud, Senior Economist at Zillow:

“The American Dream is still owning a home. There’s a lot of pent-up demand for ownership; that isn’t going to go away.”

Let’s explore just a few of the reasons why so many Americans continue to value homeownership.

The Financial Benefits of Owning a Home

One possible reason homeownership is viewed so highly is because owning a home is a significant wealth-building tool. That may be why Jessica Lautz, Deputy Chief and VP of Research at the National Association of Realtors (NAR), says:

“Homeownership is the number one way to build wealth in America.”

Over time, owning a home not only helps boost your own net worth, but it also sets future generations up for success as you pass that wealth down. Habitat for Humanity explains:

“Overall, homeownership promotes wealth building by acting as a forced savings mechanism and through home value appreciation. Homeowners make monthly payments that increase their equity in their homes by paying down the principal balance of their mortgage. . . . In addition, owning a home promotes intergenerational homeownership and wealth building. Children of homeowners transition to homeownership earlier — lengthening the period over which they can accumulate wealth . . .”

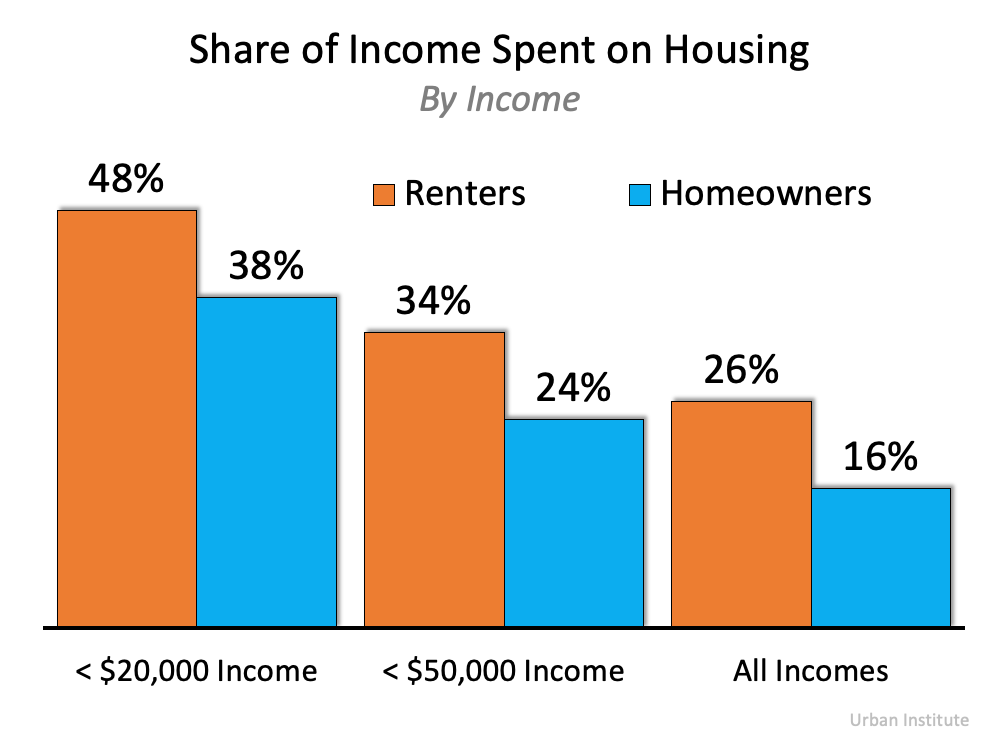

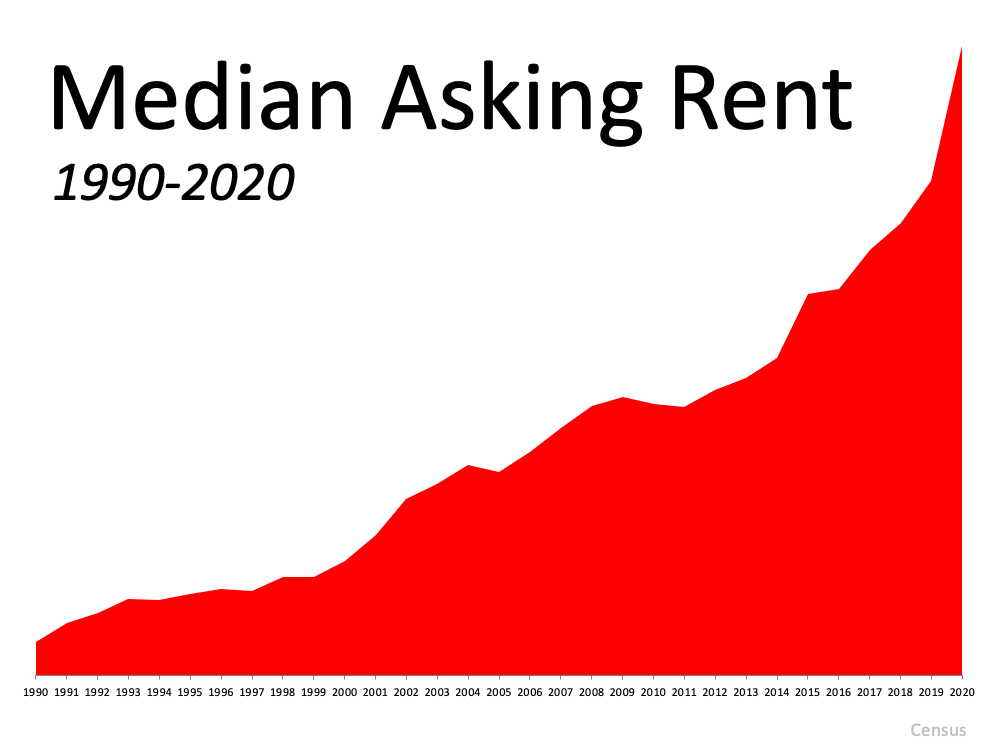

It can also provide meaningful financial stability compared to renting. When you buy with a fixed-rate mortgage, you can lock in your monthly housing payments for the length of your home loan.

The Non-Financial Benefits of Homeownership

But, owning a home offers more than just financial benefits—it benefits you socially and emotionally too. Your home provides feelings of achievement, responsibility, and more. In a recent survey, Fannie Mae outlines just a few of these more emotionally-driven benefits, including:

“The top three were having control over what you do with your living space (94%) to having a sense of privacy and security (91%) and having a good place for your family or to raise your children (90%) . . .”

What Does That Mean for You?

If your idea of the American Dream involves greater freedom, security, and prosperity, homeownership could be a key player in bringing that dream to life. And with mortgage rates now on a downward trend, it might be a good time for you to consider making a move.

If you’re ready and able to buy, know that there are incredible benefits waiting at the end of your journey. You’ll gain more than just a home – it’s a place to grow your wealth and call your very own. Like Ksenia Potapov, Economist at First American says:

“…homeownership remains an important driver of wealth accumulation and the largest source of total wealth among most households.”

Bottom Line

Buying a home is a powerful decision and the cornerstone of the American Dream. If finding a place to call your own is part of your dream for this year, connect with The Caton Team, a trusted, local real estate advisor to start the process today.

Got Questions? The Caton Team is here to help.

Call | Text | Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB | BLOG

We love what we do and would love to help you navigate your sale or purchase of Residential Real Estate. Please reach out for a personal consultation. Please enjoy our free resources below and get to know our team from our TESTIMONIALS.

Effective. Efficient. Responsive. The Caton Team 🏡 How can The Caton Team help You?

TESTIMONIALS | HOW TO SELL | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TRUST AGREEMENTS | HEALTH CARE DIRECTIVES | TESTIMONIALS |

Get exclusive inside access when you follow us on Facebook & Instagram

TESTIMONIALS | HOW TO SELL | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TRUST AGREEMENTS | HEALTH CARE DIRECTIVES | TESTIMONIALS |

Got Real Estate Questions? The Caton Team is here to help.

We strive to be more than just Realtors – we are also your home resource. If you have any real estate questions, concerns, need a referral, or some guidance – we are here for you. Contact us at your convenience – we are but a call, text or click away!

The Caton Team believes, in order to be successful in the San Fransisco | Peninsula | Bay Area | Silicon Valley Real Estate Market we have to think and act differently. We do this by positioning our clients in the strongest light, representing them with the utmost integrity, while strategically maneuvering through negotiations and contracts. Together we make dreams come true.

A mother and daughter-in-law team with over 35 years of combined, local Real Estate experience and knowledge – wouldn’t you like The Caton Team to represent you? Let us know how we can be of service. Contact us any time.

Call | Text | Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB| BLOG

The Caton Team – Susan & Sabrina

A Family of Realtors

Effective. Efficient. Responsive.

What can we do for you?

Website | The Caton Team Testimonials | Our Blog – The Real Estate Beat | Search for Homes | Facebook | Instagram | HomeSnap | Pinterest | LinkedIn Sabrina | Photography | Photography Blog

Berkshire Hathaway HomeServices – Drysdale Properties, Redwood City Ca.

DRE # | Sabrina 01413526 | Susan 01238225 | Team 70000218 | Office 01499008

The Caton Team does not receive compensation for any posts. Information is deemed reliable but not guaranteed. Third-party information not verified.

![Should I Rent or Should I Buy? [INFOGRAPHIC] | Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/07/20220715-MEM.png)

You must be logged in to post a comment.