I read this article HERE. By Tim Brookes

You can fill your home with sensors that measure things like temperature, humidity, whether you left the garage door open, and who’s at home. Valuable as these are, there’s one sensor that stands head and shoulders above the rest in terms of the amount of money and hassle it can save you.

Best of all, you don’t necessarily need to set up a smart home system if you buy the right one.

Water leak sensors could save you thousands

A water leak in your home can be disastrous, especially if it occurs on an upper level. Water warps flooring, destroys electronics, and finds its way into every nook and cranny. Even if you can dry the place out, you’re looking at weeks of running heaters and dehumidifiers, and potentially moving out of your home in the interim.

That’s where water leak sensors come in. These tiny, battery-powered devices are some of the simplest home sensors you can buy. They typically feature two metallic contacts and are placed directly on a surface beneath a potential leak source. When a leak occurs, water bridges the connection between the two contacts and triggers an alert.

You can fill your home with sensors that measure things like temperature, humidity, whether you left the garage door open, and who’s at home. Valuable as these are, there’s one sensor that stands head and shoulders above the rest in terms of the amount of money and hassle it can save you.

Best of all, you don’t necessarily need to set up a smart home system if you buy the right one.

Water leak sensors could save you thousands

A water leak in your home can be disastrous, especially if it occurs on an upper level. Water warps flooring, destroys electronics, and finds its way into every nook and cranny. Even if you can dry the place out, you’re looking at weeks of running heaters and dehumidifiers, and potentially moving out of your home in the interim.

That’s where water leak sensors come in. These tiny, battery-powered devices are some of the simplest home sensors you can buy. They typically feature two metallic contacts and are placed directly on a surface beneath a potential leak source. When a leak occurs, water bridges the connection between the two contacts and triggers an alert.

This gives you a decent amount of warning to be able to rectify the problem by shutting off the water and fixing the leak. Like any smart home sensor that you place in your house, this gives you a useful trigger to play with that you can build automations around.

While some water leak sensors are pure smart home devices and only send a trigger to your smart home platform of choice, many also include a shrill audible alarm that makes them ideal for anyone who doesn’t yet have a smart home (or is still in the process of building one).

I’ve got three IKEA Badring ($13) water leak sensors in my house (kitchen, bathroom, and garage near the water heater), and I’m probably going to get another to detect roof leaks. They’re powered by a single AAA battery and have a speaker on them.

Don’t just buy them, automate them

Whatever water leak sensors you end up going for, make sure you set them up so that they perform their duty adequately. I use Home Assistant, which won’t necessarily alert you when a water leak sensor detects a leak. You’ll see the dashboard update, but unless you go out of your way to set up an automation then your sensor investment could be for nothing.

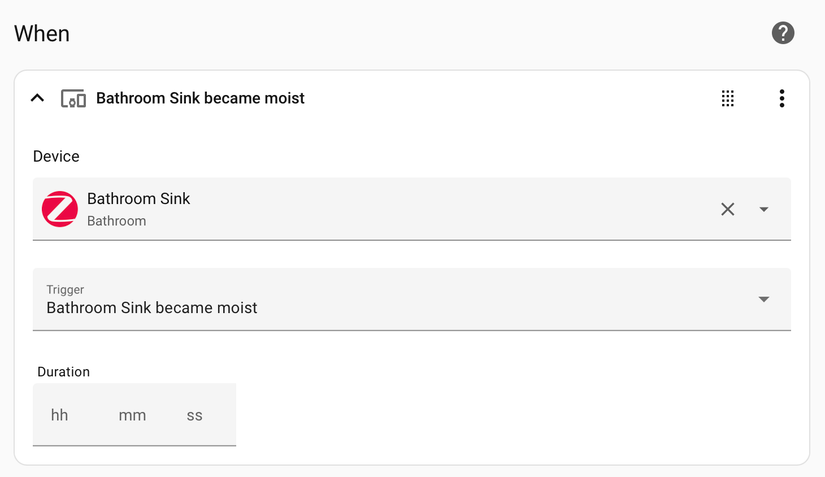

You can do this in Home Assistant’s dashboards under Settings > Automation & scenes using the “Create automation” button. Use the “Device” trigger to select your sensor, then use the “became moist” trigger and (if you want) specify a duration (or leave it blank to immediately send the alert).

Now you can set up the “Then do” actions, like sending a critical alert to your Home Assistant companion app, sounding some sort of alarm on your smart speakers, flashing the lights—whatever you think you’ll need to get ahead of the problem.

Conversely, I’ve mirrored my Home Assistant setup to Apple Home, which automatically triggers alerts for me. Apple Home goes as far as sounding a critical alert whenever a leak is detected, which means the notification overrides any Focus modes I’m in and makes an audible alert on my devices.

Once you’ve set up your automation, it’s a good idea to test it out. You can do this by bridging the gap between the two contacts using your fingers or a piece of wet paper towel. Make sure you let other household members know that you’re performing a test!

Got the IKEA Badring sensors? You might have an issue “resetting” them after an alert (I’ve noticed this in Home Assistant and Apple Home). To clear the leak, dry the detector, and then try shorting the sensors again three times in quick succession.

Pair sensors with a shut-off valve for best results

Smart homes are at their best when they’re fully automated systems, which is where automatic shut-off valves come in. By adding one of these to your home, you can trigger an automatic shut-off whenever you detect a water leak. You’ve got a few different models to choose from, like the EcoNet Bulldog Valve Robot ($215), which uses Z-Wave, and the YoLink FlowSmart range, which allows you to pair a sensor directly with the shut-off valve to avoid the middleman.

You can pick between in-line valves and robots designed to turn existing valves. In-line solutions will require a more involved install, whereas robots that turn your existing water shutoff valve are an easier DIY solution. Since these motors need to be strong enough to move a valve, they’ll need to be connected to mains power.

One last tip is to set up some sort of yearly reminder to test your sensors, check battery levels, and replace anything that’s not working as necessary. This goes for all the sensors in your house, especially any you use to trigger a home alarm system.

Got Questions? The Caton Team is here to help.

Cell| Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB | BLOG

We love what we do and would love to help you navigate your sale or purchase of Residential Real Estate. Please reach out for a personal consultation. Please enjoy our free resources below and get to know our team from our TESTIMONIALS.

Effective. Efficient. Responsive. The Caton Team 🏡

How Can The Caton Team Help You?

TESTIMONIALS | HOW TO SELL | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TRUST AGREEMENTS | HEALTH CARE DIRECTIVES | TESTIMONIALS

Get exclusive inside access when you follow us on Facebook & Instagram

TESTIMONIALS | HOW TO SELL | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TRUST AGREEMENTS | HEALTH CARE DIRECTIVES | TESTIMONIALS

Got Real Estate Questions? The Caton Team is here to help.

We strive to be more than just Realtors – we are also your home resource. If you have any real estate questions, concerns, need a referral, or some guidance – we are here for you. Contact us at your convenience – we are but a call, text, or click away!

The Caton Team believes, in order to be successful in the San Francisco | Peninsula | Bay Area | Silicon Valley Real Estate Market, we have to think and act differently. We do this by positioning our clients in the strongest light, representing them with the utmost integrity, while strategically maneuvering through negotiations and contracts. Together we make dreams come true.

A mother and daughter-in-law team with over 35 years of combined local Real Estate experience and knowledge – wouldn’t you like The Caton Team to represent you? Let us know how we can be of service. Contact us any time.

Cell | Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB| BLOG

The Caton Team – Susan & Sabrina

A Family of Realtors

Effective. Efficient. Responsive.

What can we do for you?

Website | The Caton Team Testimonials | Our Blog – The Real Estate Beat | Search for Homes | Facebook | Instagram | HomeSnap | Pinterest | LinkedIn Sabrina | Photography | Photography Blog

Berkshire Hathaway HomeServices – Drysdale Properties, Redwood City Ca.

DRE # | Sabrina 01413526 | Susan 01238225 | Team 70000218 | Office 01499008

The Caton Team does not receive compensation for any posts. Information is deemed reliable but not guaranteed. Third-party information not verified.

:max_bytes(150000):strip_icc():format(webp)/Screenshot2025-10-22at4.30.33PM-4e7a7f7cf2f545feb3c3a66e47a6317c.png)

:max_bytes(150000):strip_icc():format(webp)/GettyImages-88878477-b26cbd4b23004302942447bd2f4ba170.jpg)

:max_bytes(150000):strip_icc():format(webp)/Screenshot2025-10-22at4.31.17PM-0511e0a1392c4be3957e9ec78b1648ca.png)

:max_bytes(150000):strip_icc():format(webp)/Screenshot2025-10-22at4.32.43PM-a8b17595ca19449385dee6b488e8b541.png)

You must be logged in to post a comment.