Designers and stagers are finding ways to offer people who work from home more versatility than a dedicated workspace often provides.

Even though remote work remains commonplace, some real estate professionals and home stagers say the home office is losing its luster. Many home buyers are reclaiming this space for other nonwork uses.

The shunning of the home office is already taking root at The Astor, a recently restored luxury condo building in New York. Ash Staging, an interior design and home staging firm, recently chose to omit the home office when styling a model residence in the historic building. The firm transformed the fourth bedroom, traditionally a home office, into a flexible den with lounging space geared toward relaxation, entertainment or as a quiet nook for work. The sales team at the building believes this setup is resonating more with home buyers.

“We continue to see luxury buyers valuing flexibility and versatility in their space,” says Kyle Egan, a real estate agent with Douglas Elliman who handles sales at The Astor. “So, this area was designed as a cozy lounge and media room with a desk nook that can serve as a work spot when needed. We’ve seen a very positive response to this setup as buyers continue to seek out layouts and floorplans that allow the freedom to customize their home to fit their lifestyle.”

Drawing from similar inspiration, the real estate and design team at 53 West 53, a Manhattan condo tower with 161 residences, also decided to exclude the home office in a recent home staging project. Instead, the sales team converted an office space into a game lounge complete with a fully stocked minibar and foosball table.

Quitting the Home Office

Recent studies have shown that at-home workers have flexibility when choosing where in the home to work. They’re no longer tethered to cords and outlets, and they don’t need to plug into a dedicated space each day. They can easily take a laptop to a kitchen island, living room sofa or even a neighborhood coffee shop.

About one-third of consumers who work remotely say they have a dedicated office space at home, according to the “State of Remote Work 2023(link is external),” a study conducted by social media technology firm Buffer. But of that group, 45% say their “home office” is located within another room, like a bedroom, kitchen or living room. Fourteen percent of remote workers say they prefer to move from room to room during their workday.

Some homeowners may prefer not to devote an entire space to a home office. They’re seeking an easily adaptable, flexible space, whether that’s for entertainment, lounging or even the occasional work, Egan says. “Homes became everything for people during the pandemic—their office, their movie theater, their bar and restaurant, their kids’ classroom and even more,” he adds. “Now that many people are back to working in offices, at least part of the time, they’re ready to ditch the home office and incorporate a flexible space that brings more fun and vibrancy back into the home.”

Not a Singular Space

Egan says study or work nooks may offer the same benefits as a larger home office. However, the goal remains the same: prioritizing design and comfort. “We recognize the modern buyer’s desire to blend functionality and aesthetics without compromising valuable space,” he says, noting this trend may accelerate in dense markets like New York.

Researchers have been studying the design of home office spaces and what works best for productivity. Many studies attribute a dedicated office space to a boost in productivity and avoiding constant distractions. But the studies also acknowledge that’s not possible for everyone.

Georgia Southern University reviewed numerous studies(link is external) that explored home office design during the pandemic. The review found the best results from a home office that prioritizes ergonomics and elements from nature and takes into account light and noise. Regardless of where that “office” is located and whether it has to serve multiple purposes, a few research-backed tips for setting up an at-home workspace include:

- Pick a spot near natural daylight, preferably near a window. Otherwise, add ambient and task lighting.

- Use headphones to block out noise, if needed, and portable screen dividers to block out visual distractions if you don’t have a dedicated workspace.

- Incorporate nature or go outside for fresh air occasionally. Set up your workspace near greenery and plants—nature views have been tied to increased energy for remote workers.

- Get moving: Studies suggest that remote workers make a point to stand up and move around for at least two minutes every 30 minutes during the workday to help avoid eye strain, back pain and headaches.

- Add in a recreational spot. Researchers suggest having a lounging area in or near your office for a different type of seating than a desk chair for short breaks.

Egan says he believes more home shoppers will continue to prioritize multi-use spaces inside the home for work and play. As such, his company will continue to stage homes to showcase how spaces can be used in multiple ways. “We want to show the adaptability of the space and its ability to be integrated into all lifestyles—from gathering with friends to hosting a family movie night to taking a work call,” Egan says.

Content by Melissa Dittmann Tracey

Melissa Dittmann Tracey is a contributing editor for REALTOR® Magazine, editor of the Styled, Staged & Sold blog, and produces a segment called “Hot or Not?(link is external)” in home design that airs on NAR’s Real Estate Today radio show. Follow Melissa on Instagram and Twitter at @housingmuse.

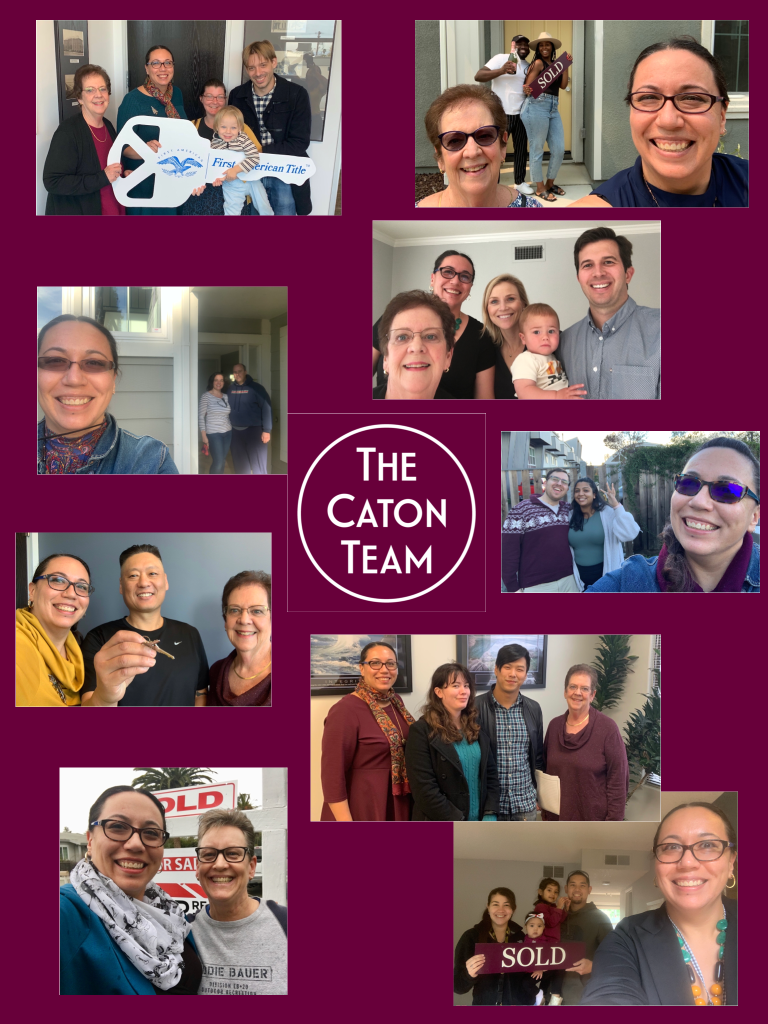

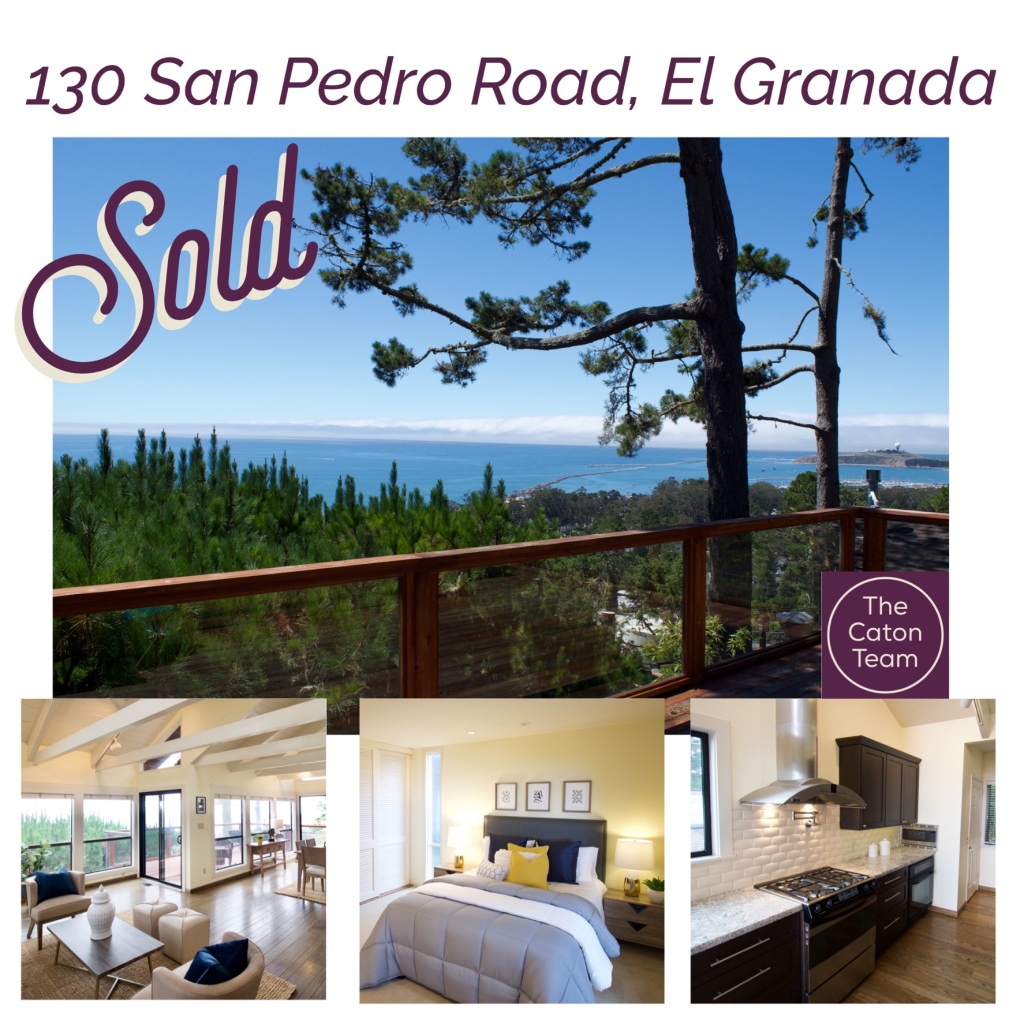

Got Questions? The Caton Team is here to help.

Call | Text | Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB | BLOG

We love what we do and would love to help you navigate your sale or purchase of Residential Real Estate. Please reach out for a personal consultation. Please enjoy our free resources below and get to know our team from our TESTIMONIALS.

Effective. Efficient. Responsive. The Caton Team 🏡 How can The Caton Team help You?

TESTIMONIALS | HOW TO SELL | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TRUST AGREEMENTS | HEALTH CARE DIRECTIVES | TESTIMONIALS |

Get exclusive inside access when you follow us on Facebook & Instagram

TESTIMONIALS | HOW TO SELL | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TRUST AGREEMENTS | HEALTH CARE DIRECTIVES | TESTIMONIALS |

Got Real Estate Questions? The Caton Team is here to help.

We strive to be more than just Realtors – we are also your home resource. If you have any real estate questions, concerns, need a referral, or some guidance – we are here for you. Contact us at your convenience – we are but a call, text or click away!

The Caton Team believes, in order to be successful in the San Fransisco | Peninsula | Bay Area | Silicon Valley Real Estate Market we have to think and act differently. We do this by positioning our clients in the strongest light, representing them with the utmost integrity, while strategically maneuvering through negotiations and contracts. Together we make dreams come true.

A mother and daughter-in-law team with over 35 years of combined, local Real Estate experience and knowledge – wouldn’t you like The Caton Team to represent you? Let us know how we can be of service. Contact us any time.

Call | Text | Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB| BLOG

The Caton Team – Susan & Sabrina

A Family of Realtors

Effective. Efficient. Responsive.

What can we do for you?

Website | The Caton Team Testimonials | Our Blog – The Real Estate Beat | Search for Homes | Facebook | Instagram | HomeSnap | Pinterest | LinkedIn Sabrina | Photography | Photography Blog

Berkshire Hathaway HomeServices – Drysdale Properties, Redwood City Ca.

DRE # | Sabrina 01413526 | Susan 01238225 | Team 70000218 | Office 01499008

The Caton Team does not receive compensation for any posts. Information is deemed reliable but not guaranteed. Third-party information not verified.

You must be logged in to post a comment.