“When my wife and I decided to sell our condo and move out of the country, it was an easy choice of who to choose as our real estate agents. The Caton Team! It was Susan Caton that had helped me purchase the condo over 20 years ago and all I could remember was how easy she made it for me to go through all the paperwork and purchasing process. So, contacting Susan and Sabrina to assist us with selling the same condo was almost a perfect ending to our “story” in the Bay Area. Nothing had changed with the addition of Sabrina in the Caton power team – the easy, friendly and transparent way of planning and figuring out details of selling our condo was the very same I had experienced when purchasing it. The added difficulty of completing the sale while we had already moved overseas was not a hindrance at all. Online processes and meticulous advice kept us in the loop of what needed to be done and complete it on time. So, all I can say is a big “THANK YOU” to Susan and Sabrina, for being with our family during our Bay Area adventure and beyond!”

- John and Sasha

Got Questions? The Caton Team is here to help.

Call | Text | Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB | BLOG

We love what we do and would love to help you navigate your sale or purchase of Residential Real Estate. Please reach out for a personal consultation. Please enjoy our free resources below and get to know our team from our TESTIMONIALS.

Effective. Efficient. Responsive. The Caton Team 🏡 How can The Caton Team help You?

TESTIMONIALS | SELLING YOUR HOME WITH THE CATON TEAM | HOW TO SELL | VIRTUAL STAGING | BUYING YOUR HOME WITH THE CATON TEAM | BUYING INFO | MOVING | TESTIMONIALS |

Get exclusive inside access when you follow us on Facebook & Instagram

TESTIMONIALS | SELLING YOUR HOME WITH THE CATON TEAM | HOW TO SELL | VIRTUAL STAGING | BUYING YOUR HOME WITH THE CATON TEAM | BUYING INFO | MOVING | TESTIMONIALS |

Got Real Estate Questions? The Caton Team is here to help.

We strive to be more than just Realtors – we are also your home resource. If you have any real estate questions, concerns, need a referral, or some guidance – we are here for you. Contact us at your convenience – we are but a call, text or click away!

The Caton Team believes, in order to be successful in the San Fransisco | Peninsula | Bay Area | Silicon Valley Real Estate Market we have to think and act differently. We do this by positioning our clients in the strongest light, representing them with the utmost integrity, while strategically maneuvering through negotiations and contracts. Together we make dreams come true.

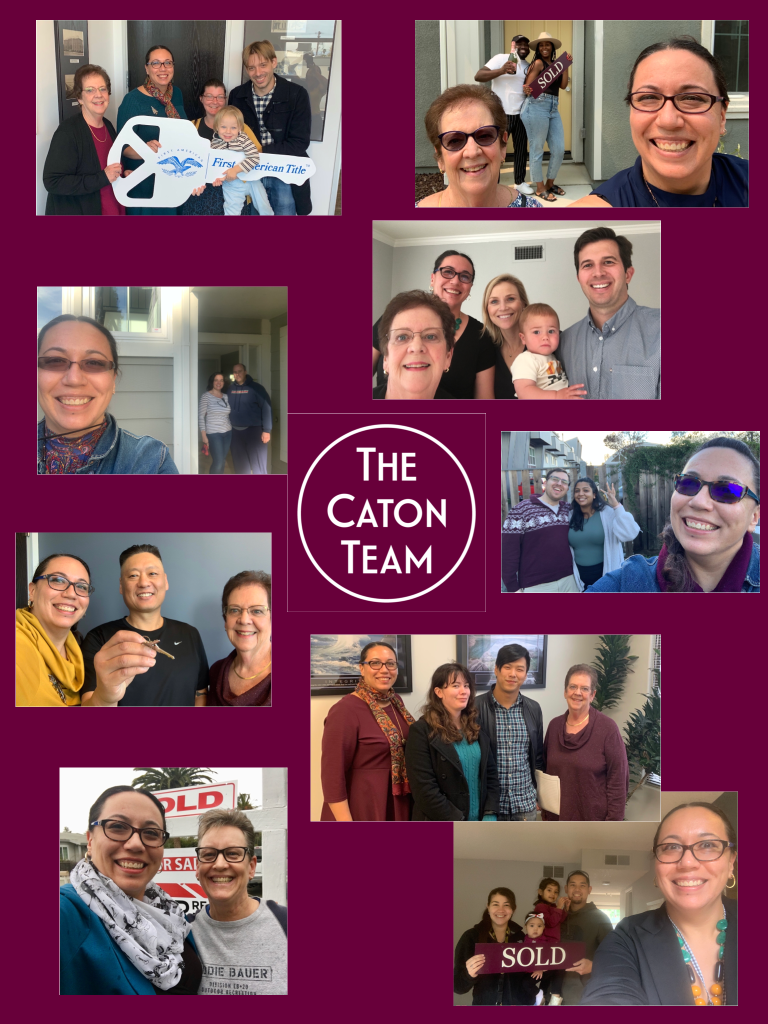

A mother and daughter-in-law team with over 35 years of combined, local Real Estate experience and knowledge – wouldn’t you like The Caton Team to represent you? Let us know how we can be of service. Contact us any time.

Call | Text | Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB | BLOG

The Caton Team – Susan & Sabrina

A Family of Realtors

Effective. Efficient. Responsive.

What can we do for you?

Website | The Caton Team Testimonials | Our Blog – The Real Estate Beat | Search for Homes | Facebook | Instagram | HomeSnap | Pinterest | LinkedIn Sabrina | Photography | Photography Blog

Berkshire Hathaway HomeServices – Drysdale Properties, Redwood City Ca.

DRE # | Sabrina 01413526 | Susan 01238225 | Team 70000218 | Office 01499008

The Caton Team does not receive compensation for any posts. Information is deemed reliable but not guaranteed. Third-party information not verified.

You must be logged in to post a comment.