I read this article HERE.

Responses from more than 600 real estate professionals describe the negative effects of closing crucial housing, loan and insurance programs offered through FHA, HUD, VA and NFIP.

© Bongkod Worakandecha / iStock / Getty Images Plus

On Oct. 22, a few weeks into the federal government shutdown, the National Association of REALTORS® issued a Call For Information to its full membership to take the pulse on the ramifications for real estate professionals and their clients.

Unlike a traditional Call For Action (CFA), which prompts members to simply click and send a message to their members of Congress, this request invited NAR members to share their own stories about how the government shutdown was impacting their clients, businesses and communities.

“What’s at stake for housing and homeownership nationwide is important for Americans to thrive and step into their dreams,” wrote one member. “Our government must reopen for the people.”

The response rate was remarkable: 641 members from all 50 states, Washington, D.C., and Puerto Rico submitted firsthand accounts, representing 386 local associations—about 35% of all associations nationwide. While engagement metrics differ from a one-click CFA, the volume and depth of these NAR member responses underscored the power of REALTORS® as trusted messengers on the front lines of the housing market.

The Call For Information shows:

- 35.6% of stories mention one of more federal housing programs, like the Federal Housing Administration (FHA), U.S. Department of Housing & Urban Development (HUD), Internal Revenue Service (IRS), National Flood Insurance Program (NFIP), U.S. Department of Agriculture (USDA), and U.S. Department of Veterans Affairs (VA).

- The most frequently cited impacts were USDA, VA, NFIP/Flood Insurance and FHA.

- There were over 60 stories highlighting hardship, family strain, or the domino effects of delayed transactions.

- 259 unique associations were represented in responses (approximately 24% of local boards)

Collapsing Deals, Low Morale

Perhaps unsurprisingly, most responses were from high-population states including Florida, Texas and California.

One North Carolina agent, who is a REALTOR®, explained that home sales are being delayed due to holdups in NFIP flood insurance renewals and USDA loan approvals, two essential programs for the state’s coastal and rural areas. In some North Carolina communities, almost every financed home purchase relies on one or both of these federal services. As a result, deals are collapsing, and families are losing the homes they’ve worked tirelessly to obtain.

The effects extend well beyond the housing market: Many North Carolinians, including military families and federal employees, are struggling to afford basic necessities, while local small businesses that depend on their spending are seeing steep drops in revenue. “The financial strain is real, the morale is low, and the longer this continues, the harder recovery will be for working families and small businesses alike,” the member reported.

Many other members reported similar experiences, with clients often feeling uncertain about the real estate market and experiencing a lack of consumer confidence. This uncertainty frequently led to stalled transactions, disrupting multiple deals, and affecting buyers, sellers, agents, lenders and contractors alike.

‘A Train Wreck’ for Escrows, Military Families and Local Businesses

“As a REALTOR®, I am seeing firsthand how the federal government shutdown is disrupting the housing market,” one member in California said. “As a NAR member, I want to help illustrate the real impacts the shutdown has had on my business, clients and community—such as delayed FHA, VA or conventional loans, especially without access to government flood insurance. Military families are being stifled by this shutdown, with delayed loans and added strain to their finances. This is a deterrent for our military service members who give their lives willingly to serve this country. Sellers are unsure about proceeding due to market volatility and concerns about affordability. So many buyers are being impacted as the buyer pool has diminished.”

The member continued: “Additionally, in California, obtaining flood insurance has become a major problem, so having sources available from the government has allowed us to close our escrows. However, without these options, due to the shutdown, it’s a train wreck for our escrows leaving us with delays and obstacles to struggle to get our escrows closed.”

Chipping Away at the Foundation

The shutdown may be centered in Washington, but its costs are being paid in every community across America.

“The National Association of REALTORS® urges Congress to come together and pass a clean, bipartisan continuing resolution or a long-term funding package to restore stability to the housing market and the broader economy. Every day that passes without action chips away at the foundation of the American Dream,” says Shannon McGahn, NAR executive vice president and chief advocacy officer.

Michael Rauber

Michael Rauber is manager of advocacy communications at the National Association of REALTORS®.

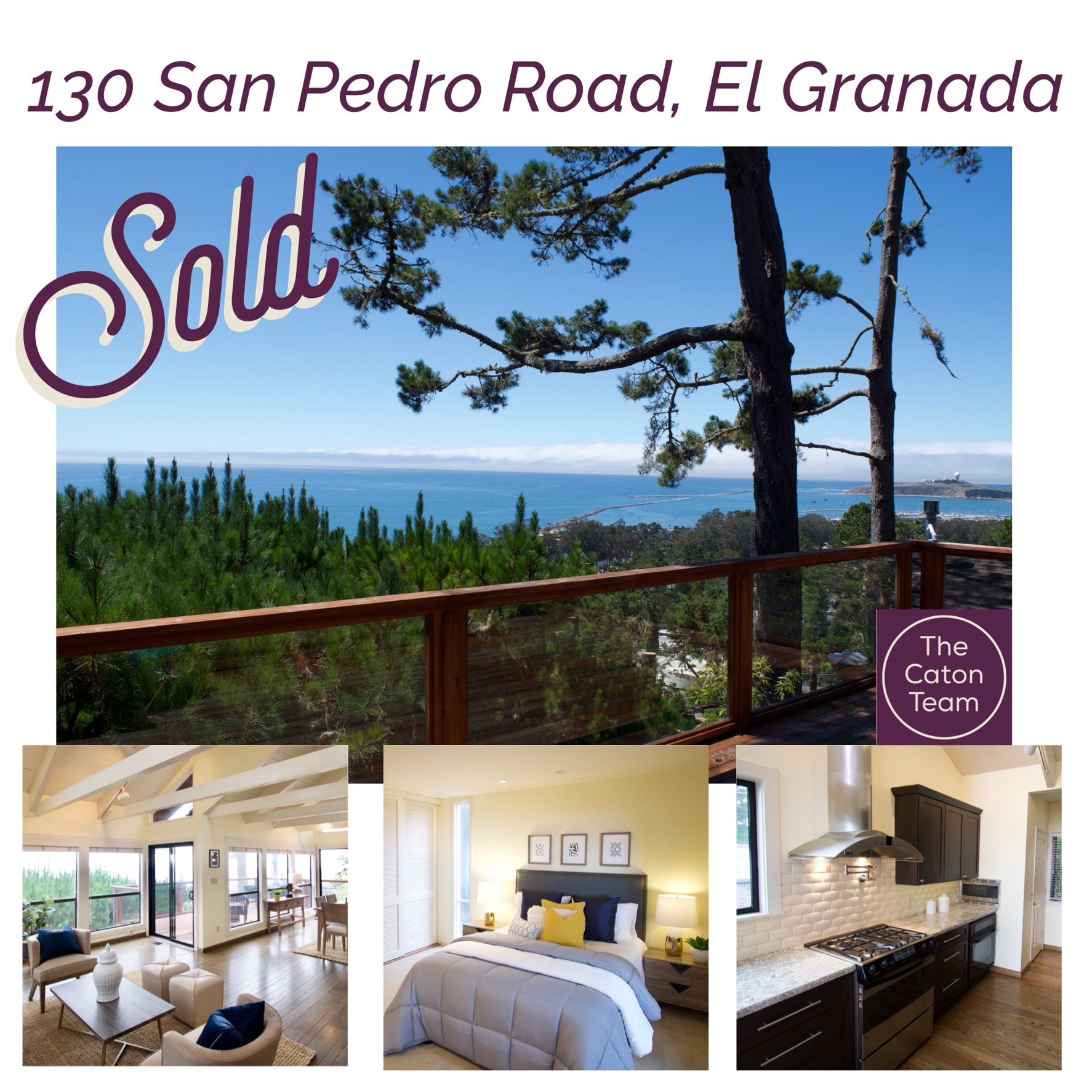

Got Questions? The Caton Team is here to help.

Cell| Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB | BLOG

We love what we do and would love to help you navigate your sale or purchase of Residential Real Estate. Please reach out for a personal consultation. Please enjoy our free resources below and get to know our team from our TESTIMONIALS.

Effective. Efficient. Responsive. The Caton Team 🏡

How Can The Caton Team Help You?

TESTIMONIALS | HOW TO SELL | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TRUST AGREEMENTS | HEALTH CARE DIRECTIVES | TESTIMONIALS

Get exclusive inside access when you follow us on Facebook & Instagram

TESTIMONIALS | HOW TO SELL | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TRUST AGREEMENTS | HEALTH CARE DIRECTIVES | TESTIMONIALS

Got Real Estate Questions? The Caton Team is here to help.

We strive to be more than just Realtors – we are also your home resource. If you have any real estate questions, concerns, need a referral, or some guidance – we are here for you. Contact us at your convenience – we are but a call, text, or click away!

The Caton Team believes, in order to be successful in the San Francisco | Peninsula | Bay Area | Silicon Valley Real Estate Market, we have to think and act differently. We do this by positioning our clients in the strongest light, representing them with the utmost integrity, while strategically maneuvering through negotiations and contracts. Together we make dreams come true.

A mother and daughter-in-law team with over 35 years of combined local Real Estate experience and knowledge – wouldn’t you like The Caton Team to represent you? Let us know how we can be of service. Contact us any time.

Cell | Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB| BLOG

The Caton Team – Susan & Sabrina

A Family of Realtors

Effective. Efficient. Responsive.

What can we do for you?

Website | The Caton Team Testimonials | Our Blog – The Real Estate Beat | Search for Homes | Facebook | Instagram | HomeSnap | Pinterest | LinkedIn Sabrina | Photography | Photography Blog

Berkshire Hathaway HomeServices – Drysdale Properties, Redwood City Ca.

DRE # | Sabrina 01413526 | Susan 01238225 | Team 70000218 | Office 01499008

The Caton Team does not receive compensation for any posts. Information is deemed reliable but not guaranteed. Third-party information not verified.

You must be logged in to post a comment.