Home Selling in the Age of Coronavirus: It’s a Whole Different World

THIS ARTICLE POSTED AT AN EARLIER DATE – Please adhere to new County Safety Standards.

In the not so distant past, Seattle open houses were packed with home buyers eagerly poking their heads in closets, perusing spec sheets, munching on snacks, and offering bids above asking price in this ultracompetitive market.

Then on Jan. 20, a Washington state resident became the first confirmed case of the coronavirus in the U.S.—and slowly but surely, everything changed.

According to Seattle-based real estate agents, open houses are now significantly more guarded affairs, and some have been canceled outright. Attendance of the open houses that are still taking place has been noticeably lighter than it has been traditionally, and attendees seem to be less interactive—most are doing their best to keep their distance from one another, and don’t dare crack open a closet or touch a countertop without clenching an antiseptic wipe.

“We are seeing a lot more hand sanitizer and Clorox wipes at open houses,” says Wes Jones managing broker with Keller Williams in the Seattle suburb of Bellevue, WA. “We also make sure to wipe down the front door handle a number of times throughout the open house. It also appears that not shaking hands at all is quickly becoming acceptable.”

Meanwhile, more home sellers leery of the potential health risk of strangers at their open houses are refusing to host them.

“We did have one client decide not to have us continue with their public open houses,” Jones says. “We will continue to show their property by appointment only.”

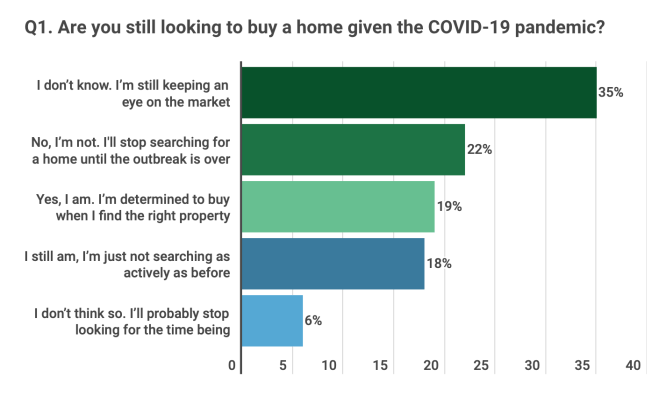

He’s also seen more home buyers pulling out of the market and putting their searches on hold for now. But “the worst-case scenario is that we go from a really hot market to a more normal market,” he says of Seattle.

“I am not naive enough to believe that the overall economy may not be impacted short term by this scare,” he continues. “What could happen next? That remains to be seen.”

How the coronavirus is changing how people sell homes

Welcome to the reality of selling a home in the era of the coronavirus. Anxieties abound, not only about catching the virus that causes COVID-19, but also the volatile stock market, the shaky economy, and general fears of a coming recession—all of which could plunge the U.S. real estate market into a forced hibernation right when it’s supposed to leap into overdrive this spring.

While Washington state may be coronavirus ground zero with the earliest known cases, and some of the highest levels of infection in the U.S., (according to the Centers for Disease Control), the panic is being felt nationwide by real estate agents who’ve noticed a drop-off in the number of home buyers and sellers willing to mingle and make a deal.

“The coronavirus is leading to fewer home buyers searching in the marketplace, as well as some listings being delayed,” says Lawrence Yun, chief economist for the National Association of Realtors®. “In the latest flash survey, 11% of Realtors indicated a reduction in buyer traffic and 7% are reporting lower seller traffic when asked directly about the coronavirus impact on the market. The stock market crash is no doubt raising economic anxieties, while the coronavirus brings fear of contact with strangers.”

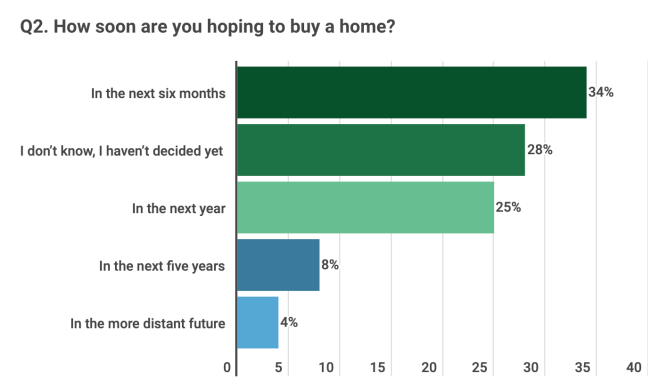

Ironically, this downturn comes at a time when buying a home is more affordable than ever. Just last week, Freddie Mac reported that interest rates hit a near 50-year low, at 3.29% for a 30-year fix-rated mortgage.

“The dramatic fall in interest rates may induce some potential buyers to take advantage of the better affordability conditions, but it is too early to assess whether lower interest rates can overcome the economic and health anxieties,” says Yun.

Nonetheless, he continues, “in the short term at least, home sales will be chopped by around 10%, compared to what would have been the case, due to the spread of coronavirus.”

Seattle’s housing market: A harbinger?

As for what could happen next, many are looking for clues in the Washington real estate market. It’s still strong, but due to the double whammy of the area’s virus exposure levels and plummeting stock portfolios, experts are watching it closely for signs of decline.

“Anytime you have local stocks like Amazon and Microsoft experiencing a 15% drop, that is a lot of perceived wealth that has been taken out of the market,” says Nick Glant, founding broker at Compass in Washington. “That said, some buyers and investors are looking at housing as a safer asset class than equities given the recent volatility.”

Glant’s biggest worry is whether the virus forces certain areas of Washington to go on lockdown.

“The only thing I would see as a detriment to selling in a significant way would be a larger-scale quarantine situation,” he says. “It will also be interesting to see what happens to relocation buyers should more travel restrictions be put in place. Tech relocation is a significant driver of our market, and if people cannot easily come out to tour properties in advance of taking a job here, they may be more apt to rent in the short term.”

Meanwhile, home buyers in other areas hit hard by COVID-19 (like California and New York) are feeling nervous, too.

“Concerns just started this week,” says Janine Acquafredda, a broker at House n Key Reality in Brooklyn, NY. “So far, homeowners haven’t voiced any concerns with regards to showings, and sellers are still listing without restriction. But I do have buyers and sellers reluctant to attend closings if it involves taking the subway, and one closing was postponed by an attorney because his client was very ill—exhibiting flu-like symptoms—and didn’t know what she had. He said, ‘I’m not going to put myself in that position.'”

How home buyers and sellers can limit their exposure

Ultimately, determined home buyers and sellers will find a way—it may just look a little different than before. For one, the days of lavish, party-atmosphere open houses with finger food or baked cookies may be over, at least for a while.

“I do think agents may rethink hosting large open-house events with spreads of food and drinks where people are picking up plates, napkins, and plasticware along with pouring drinks out of bottles,” says Cara Ameer, a real estate agent in California.

Another way home buyers and sellers are limiting their exposure is by opting for virtual tours.

“As a virtual tour provider in Washington, DC, we are seeing an uptick in demand for video and more elaborate virtual tours so homeowners don’t need to have an open house,” says Roman Caprano at Sky Blue Media. “In our market, homes sell in days, so many agents typically only invest in photos, but now they are purchasing more content.”

“These virtual tours work like Google Street [View] within a house,” says Jones, who uses Matterport software to give buyers a 3D, multidirectional spin through a property.

While it can’t completely replace an in-person showing, says Jones, “a virtual tour can help them understand the house better. For those that are concerned about the virus, this allows them to make a more informed decision about the property and whether to get out and go see it.”

Nonetheless, “the reality is real estate is a contact sport,” says Ameer. “And that means exposing yourself to a lot of potential germs from shaking hands, interacting at open houses, and touching all sorts of doorknobs and light switches multiple times a day.”

As such, she adds, “I think we need to adopt a new normal of practices during this period of time.

“I now carry a canister of disinfecting wipes in my car so I can wipe my hands and the steering wheel after being in and out of houses,” she says. “I have also wiped down lockboxes, light switches, and doorknobs on my listings, and encourage customers to do the same. While you don’t want to make anyone feel uncomfortable, it is better to err on the side of caution rather than worry about exposure. You can never be too careful.”

By Erica Sweeney | Mar 12, 2020

Erica Sweeney is a writer whose work has appeared in the New York Times, Parade, HuffPost, and other publications.

I read this article HERE

Got Real Estate Questions? The Caton Team is here to help.

We strive to be more than just Realtors – we are also your home resource. If you have any real estate questions, concerns, need a referral or some guidance – we are here for you. Contact us at your convenience – we are but a call, text or click away!

The Caton Team believes, in order to be successful in the San Fransisco | Peninsula | Bay Area | Silicon Valley Real Estate Market we have to think and act differently. We do this by positioning our clients in the strongest light, representing them with the utmost integrity, while strategically maneuvering through negotiations and contracts. Together we make dreams come true. How can The Caton Team help you?

A mother and daughter-in-law team with over 35 years of combined, local Real Estate experience and knowledge – would’t you like The Caton Team to represent you? Let us know how we can be of service. Contact us any time.

Call | Text | Sabrina 650.799.4333 | Susan 650.796.0654

Email | Info@TheCatonTeam.com

The Caton Team – Susan & Sabrina

A Family of Realtors

Effective. Efficient. Responsive.

What can we do for you?

The Caton Team Testimonials | The Caton Team Blog – The Real Estate Beat | TheCatonTeam.com | Facebook | Instagram | HomeSnap | Pintrest | LinkedIN Sabrina | LinkedIN Susan

Want Real Estate Info on the Go? Download our FREE Real Estate App: Mobile Real Estate by The Caton Team

Berkshire Hathaway HomeServices – Drysdale Properties

DRE # |Sabrina 01413526 | Susan 01238225 | Team 70000218 |Office 01499008

The Caton Team does not receive compensation for any posts. Information is deemed reliable but not guaranteed. Third party information not verified.

You must be logged in to post a comment.