Several of you have reached out to Chris regarding the main stream media’s pick up of the story I covered back in January.

Shared From SOURCE

Mortgage Borrowers Beware: Separating Fact from Fiction on the New Credit Score Tax

Shared From YOURLENDERCHRIS APRIL 24, 2023

Chris Carr NMLS# 1466899 | Cell (650) 207-4364

Here is an excerpt from the excellent website, Mortgage New Daily:

Before you stop paying your bills in the hope of cashing in, let’s separate fact from fiction. First and most importantly, you will absolutely NOT get a better deal on a mortgage rate if your credit score is lower, even if your nephew just texted you a screenshot of a news headline saying “620 FICO SCORE GETS A 1.75% FEE DISCOUNT” and “740 FICO SCORE PAYS 1% FEE.” MATTHEW GRAHAM – MORTGAGE NEWS DAILY

I strongly encourage you to read the rest of his article here: https://www.mortgagenewsdaily.com/markets/mortgage-rates-04212023 It is well-written and informative and takes the political bias and opinion out of the explanation. Just the facts. And yes, it has gotten more expensive to get a home loan–for everyone.

But to really understand what’s changed, you need to first understand that mortgage rates have a price. In other words, each rate on a rate sheet is associated with a price or fee and that price/fee goes up and and down with the rate you choose, based on how much money you want to borrower, what your credit score is and how much down payment you’re bringing to the purchase. There are a few other factors that determine rate and that is why it is so difficult to answer your question: “What are rates like today?”

With that out of the way, sometimes an interest rate comes at cost to you (that’s what we all know as “Points”) and sometimes that price/fee is a rebate to you (that’s how some lenders will quote you a “no cost loan”). What’s in the middle is something called “PAR”. This is the fancy Wall Street word for “Neutral”, meaning you don’t pay points and you don’t get a rebate. The price for mortgage rates has been increased at the direction of the Federal Housing Finance Administration because they don’t believe they are making enough money and raising these fees (because inflation). The FHFA believes this will help them maintain the financial health of Fannie Mae and Freddie Mac–the two Government Sponsored Entities that purchase many of the home loans that are originated in the United States.

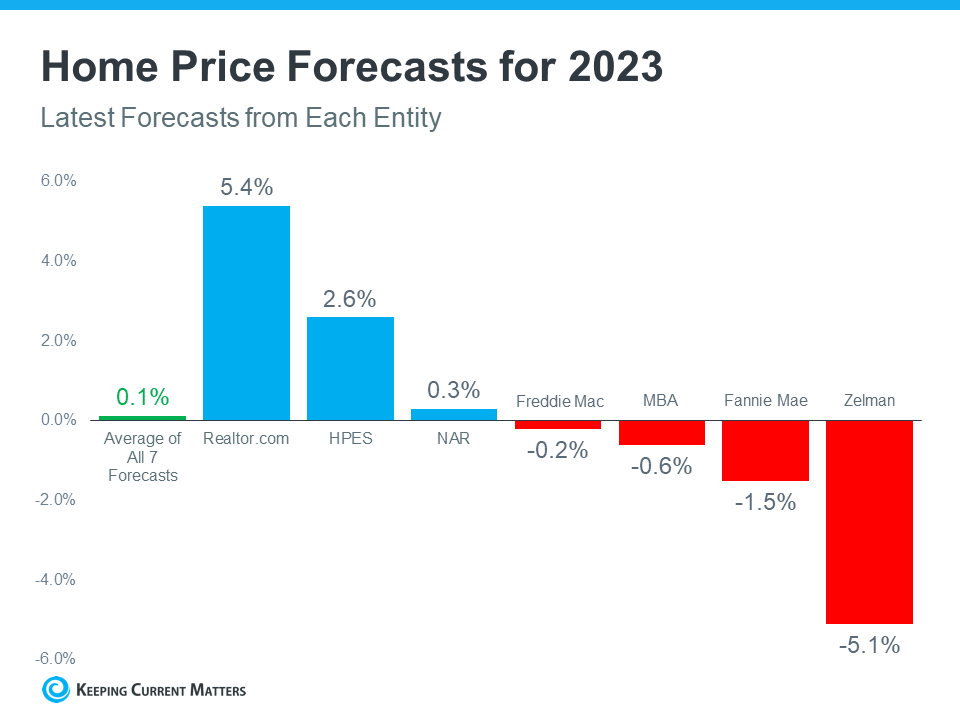

Here’s a picture proving that home loans for the purpose of purchasing just got more expensive for us all:

Now, Fannie and Freddie have what is called a “Duty to Serve” and that requires them to be focused on helping first time home buyers get into homes. That is why the chart above shows that a smaller down payment and a lower credit scores appears to be getting a better deal than say someone with higher credit and a larger down payment.

But let’s take the following example, if you have two borrowers, one with a 700 FICO and 20% down, and another with 640 and 5% down, the LLPAs (1.500%) are in fact the same, creating an “equal” playing field. However, if you have both come in with 5% the higher FICO score gets an improvement to LLPA of 0.625%, whereas if the lower FICO borrower comes in with 20%, their LLPA is 1.375% higher. With the latter, a mortgage of $600,000 results in $8,250 of additional costs to the lower credit score borrower. The point here is that the FHFA is working to create more affordable housing for those that have lower credit scores and by assumption a smaller down payment.

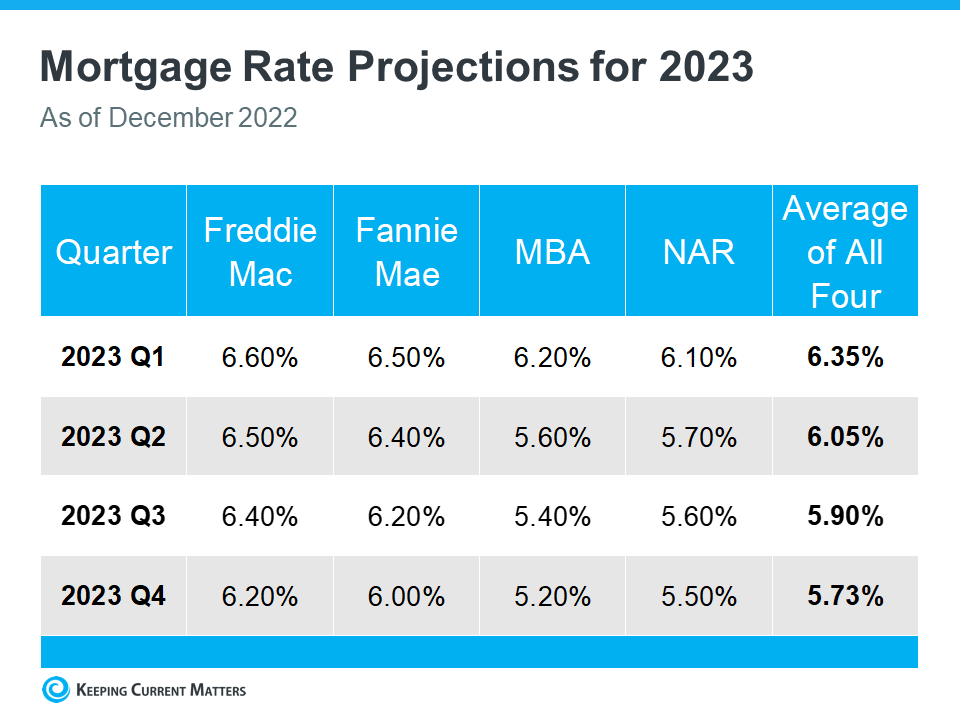

After Weeks of Decline, Mortgage Rates Increase

For the first time in over a month, mortgage rates moved up due to shifting market expectations. Home prices have stabilized somewhat, but with supply tight and rates stuck above six percent, affordable housing continues to be a serious issue for potential homebuyers. Unless rates drop into the mid five percent range, demand will only modestly recover.

Primary Mortgage Market Survey® U.S. weekly averages as of 04/20/2023

Current Mortgage Rates Data Since 1971xlsx

Week of April 17, 2023 in Review

The latest data showed signs of strength in the housing market while the labor sector is getting weaker. Plus, an important recession signal continues to reflect a slowing economy. Don’t miss these stories:

- What the Media Gets Wrong About Home Prices

- Home Builders Need to be “Starting” Something

- NAHB Reports Cautious Optimism Among Home Builders

- Job Market Getting Weaker

- Recession Signal Flashing

What the Media Gets Wrong About Home Prices

Existing Home Sales fell 2.4% from February to March to a 4.44 million unit annualized pace, per the National Association of Realtors (NAR), which was in line with estimates. Sales were 22% lower than they were in March of last year. This report measures closings on existing homes, which represent around 90% of the market, making it a critical gauge for taking the pulse of the housing sector.

What’s the bottom line? While it’s true that buyer activity slowed in March, February was an especially strong month for closings, so a slight pullback last month was understandable.

In addition, multiple data points suggest that demand remains strong. Homes stayed on the market on average for 29 days, down sharply from 34 days in February. Plus, 65% of homes sold in March were on the market for less than a month, which is up from 57% and shows homes are selling quickly when they’re priced correctly. Meanwhile, investors accounted for 17% of transactions last month, making up roughly one out of every six deals. Clearly investors are seeing the opportunity in housing right now.

Also of note, there was a 0.9% decline in the median home price to $375,700 from a year earlier. However, this is not the same as a decline in home prices as some media reports implied.

The median home price simply means half the homes sold were above that price and half were below it, and this figure can be skewed by the mix of sales among lower-priced and higher-priced homes. In fact, we could see home prices increase across all price categories, but the median price could still fall if the concentration of sales was on the lower end. Actual appreciation numbers are higher, not lower, on a year-over-year basis according to key reports from Case-Shiller, CoreLogic and the Federal Housing Finance Agency.

Home Builders Need to be “Starting” Something

Construction of new homes slowed in March, with Housing Starts falling nearly 1% from February. Building Permits, which are indicative of future supply, also fell 8.8% for the month. While Starts and Permits for single-family homes both ticked higher from February to March, they were significantly lower than in March of last year.

What’s the bottom line? The housing sector is undersupplied, and not enough inventory is heading to the market. Starts for single-family homes have been on a downward trend over the last year, with the pace of 1.191 million units in March 2022 falling all the way to 861,000 units this March. Single-family permits have followed the same pattern, declining from a pace of 1.163 million units to 818,000 over the same period.

With single-family homes remaining in high demand among buyers, the imbalance between supply and demand should continue to be supportive of prices.

NAHB Reports Cautious Optimism Among Home Builders

The National Association of Home Builders (NAHB) Housing Market Index, which is a near real-time read on builder confidence, rose one point to 45 in April, marking the fourth straight month this measure has increased. Among the components of the index, current sales conditions rose two points to 51 while sales expectations for the next six months increased three points to 50. Buyer traffic remained unchanged at 31.

What’s the bottom line? Home builder confidence has now risen 14 points since the low of 31 in December. Present sales conditions returned to expansion territory (over 50) for the first time since last September, while the future sales outlook is right at the breakeven between expansion and contraction at its highest level since June. Even though the overall confidence reading remains below 50 in contraction territory, sentiment continues to rebound in the right direction.

Job Market Getting Weaker

Initial Jobless Claims continued to move higher this month, with the number of people filing for unemployment benefits for the first time rising by 5,000 in the latest week to 245,000. This tied the third highest reading so far this year. Continuing Jobless Claims also surged to 1.865 million, up 61,000.

What’s the bottom line? Continuing Claims measure people who continue to receive benefits after their initial claim is filed and this data clearly shows that hiring has slowed. While the number can be volatile from week to week, the overall trend has been higher with an increase of around 576,000 since the low reached last September.

Plus, there’s greater evidence of workforce reductions as the four-week average of Initial Jobless Claims, which smooths out some of the weekly fluctuation among first-time filers, has hovered around 240,000 at a yearly high in recent weeks.

Recession Signal Flashing

The Conference Board released their Leading Economic Index (LEI) for March, which was down 1.2%, falling to “its lowest level since November of 2020, consistent with worsening economic conditions ahead,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators. This report is a composite of economic indexes and can signal peaks and troughs in the business cycle.

What’s the bottom line? The Conference Board explained that a warning signal occurs when the LEI 6-month growth rate on an annualized basis breaks beneath 0%. But a break beneath -4.2%, like we saw last month, is a recession signal that has been highly accurate historically. The Conference Board also stated that they believe the U.S. will enter a recession “starting in mid-2023.”

What to Look for This Week

More housing news is ahead, starting with Tuesday’s release of home price appreciation data for February from the Case-Shiller Home Price Index and the Federal Housing Finance Agency (FHFA) House Price Index. March’s New Home Sales will also be reported on Tuesday, while Pending Home Sales follows on Thursday.

Also on Thursday, the latest Jobless Claims data will be released along with the first reading for first quarter 2023 GDP. Friday brings perhaps the biggest news of the week with March’s reading for the Fed’s favored inflation measure, Personal Consumption Expenditures.

Technical Picture

Mortgage Bonds were able to stay above their 50-day Moving Average after testing it earlier in the day last Friday. The 10-year tested support at its 200-day Moving Average but remained above it at the end of last week.

Shared From Lender Chris Carr NMLS# 1466899 – SOURCE

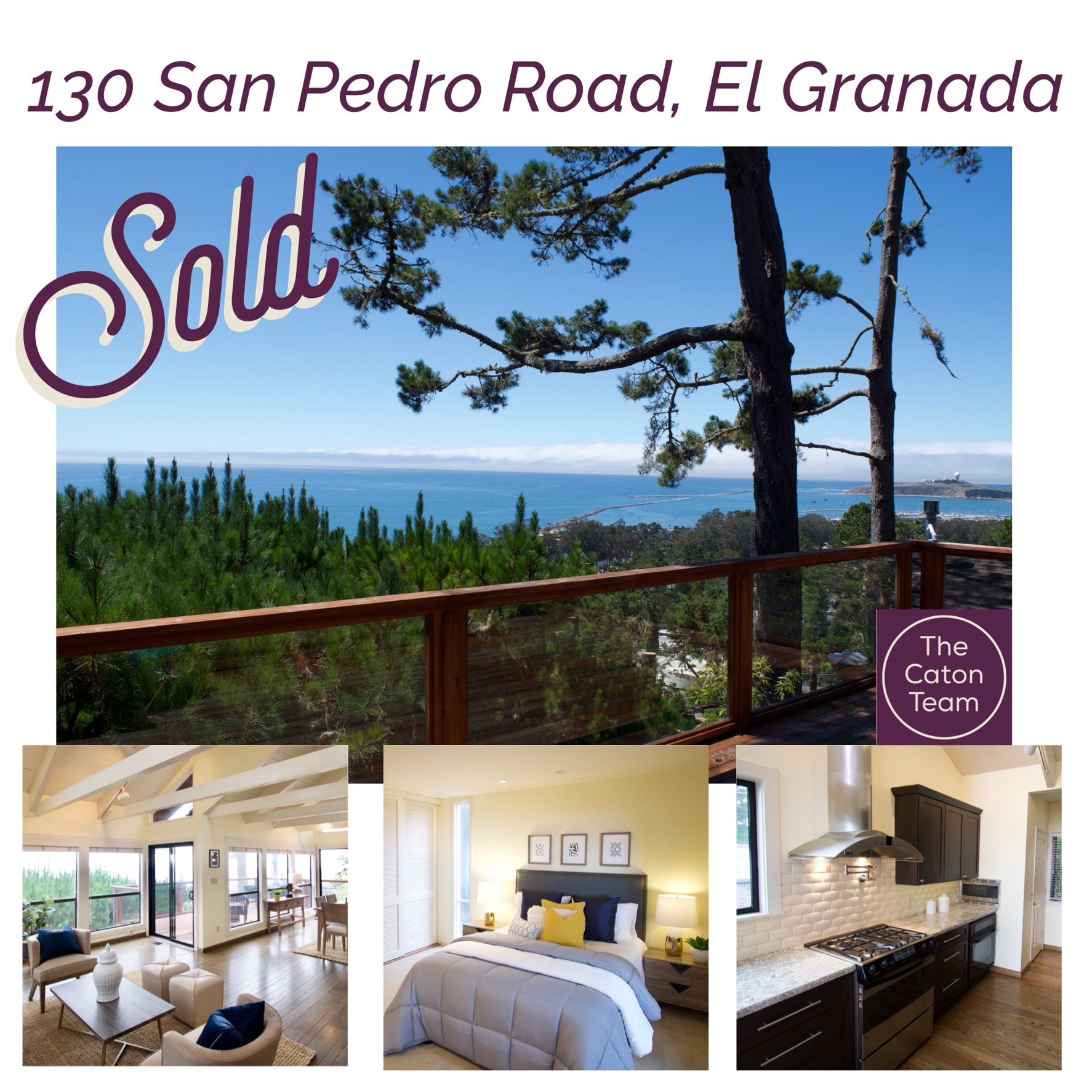

If you are considering a sale or purchase of Real Estate – The Caton Team would love to interview for the job as your Realtor. We love what we do, let us take care of you.

We believe to be successful in the Silicon Valley Real Estate Market we have to think and act differently. We do this by positioning our clients in the strongest light, representing them with integrity, while strategically maneuvering through negotiations and contracts.

A mother and daughter-in-law team with 40 years of combined, local real estate experience, knowledge, and know-how – wouldn’t you like The Caton Team to represent you? Let us know how we can be of service. Contact us any time. Call | Text | 650.799.4333 | Email | Info@TheCatonTeam.com

Effective. Efficient. Responsive. Got Questions? The Caton Team is here to help.

Call | Text | Sabrina 650.799.4333 | EMAIL | WEB | BLOG

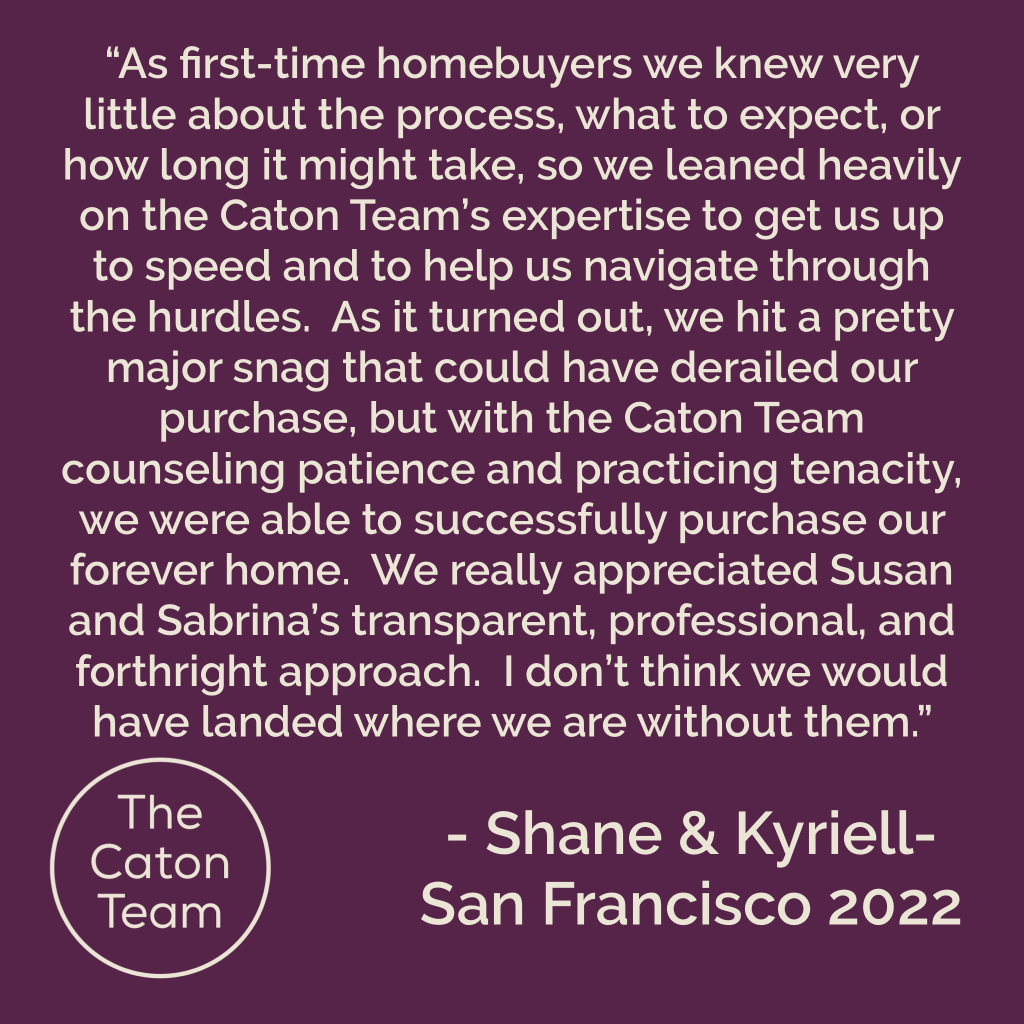

We love what we do and would love to help you navigate your sale or purchase of Residential Real Estate. Please reach out for a personal consultation. Please enjoy our free resources below and get to know our team from our TESTIMONIALS.

| HOW TO SELL | GET READY CAPITAL – Loans to Prep for Sale | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TESTIMONIALS |

Get exclusive inside access when you follow us on Facebook & Instagram

| HOW TO SELL | GET READY CAPITAL – Loans to Prep for Sale | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TESTIMONIALS |

Got Real Estate Questions? The Caton Team is here to help.

We strive to be more than just Realtors – we are also your home resource. If you have any real estate questions, concerns, need a referral, or some guidance – we are here for you. Contact us at your convenience – we are but a call, text or click away!

The Caton Team believes, in order to be successful in the San Fransisco | Peninsula | Bay Area | Silicon Valley Real Estate Market we have to think and act differently. We do this by positioning our clients in the strongest light, representing them with the utmost integrity, while strategically maneuvering through negotiations and contracts. Together we make dreams come true.

A mother and daughter-in-law team with over 35 years of combined, local Real Estate experience and knowledge – wouldn’t you like The Caton Team to represent you? Let us know how we can be of service. Contact us any time.

Call | Text | Sabrina 650.799.4333 | Susan 650.796.0654 |EMAIL | WEB| BLOG

The Caton Team – Susan & Sabrina

A Family of Realtors

Effective. Efficient. Responsive.

What can we do for you?

The Caton Team Testimonials | Blog – The Real Estate Beat | TheCatonTeam.com | Facebook | Instagram | HomeSnap | Pinterest | LinkedIn Sabrina

Berkshire Hathaway HomeServices – Drysdale Properties

DRE # |Sabrina 01413526 | Susan 01238225 | Team 70000218 |Office 01499008

The Caton Team does not receive compensation for any posts. Information is deemed reliable but not guaranteed. Third-party information not verified.

You must be logged in to post a comment.