What Lower Mortgage Rates Mean for Your Purchasing Power

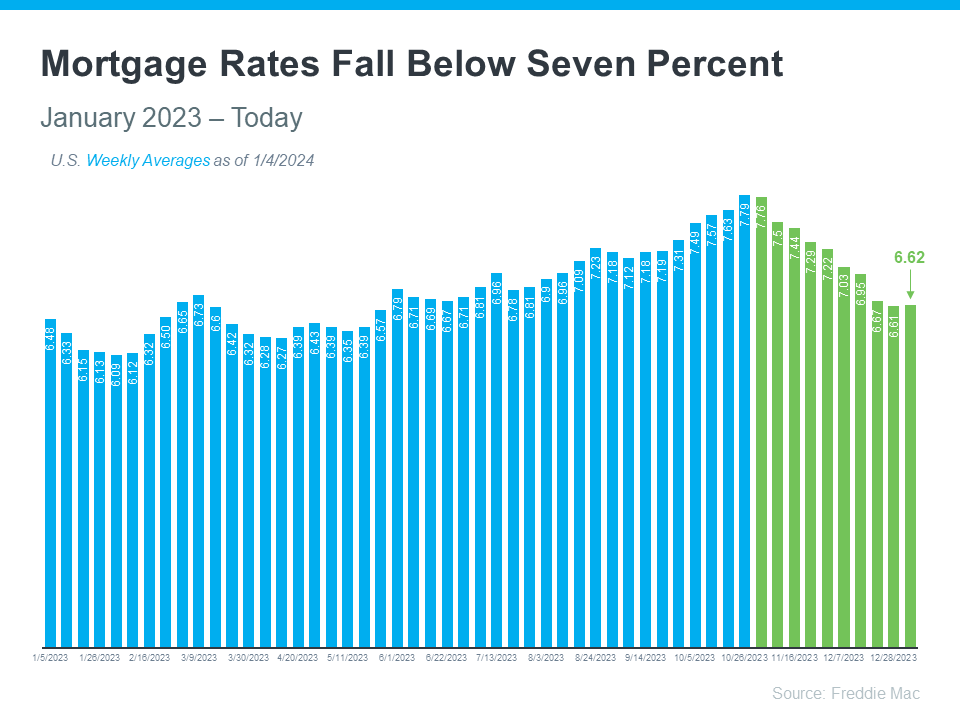

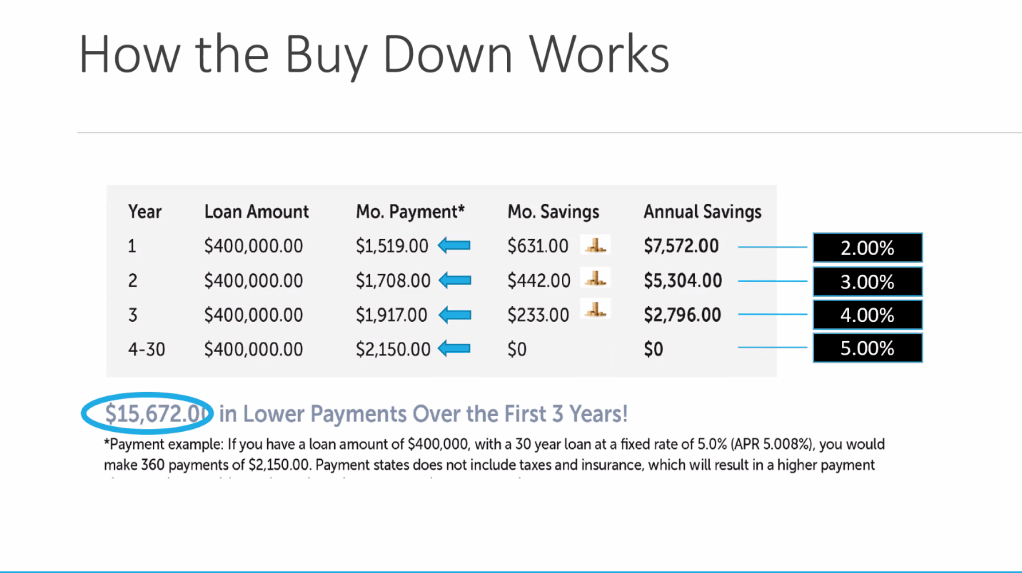

If you want to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month. Fortunately, rates for 30-year fixed mortgages have come down significantly since the end of October and are currently under 7%, according to Freddie Mac (see graph below):

This recent trend is great news for buyers. As a recent article from Bankrate says:

“The rate cool-off somewhat eases the housing affordability squeeze.”

And according to Edward Seiler, AVP of Housing Economics and Executive Director of the Research Institute for Housing America at the Mortgage Bankers Association (MBA):

“MBA expects that affordability conditions will continue to improve as mortgage rates decline . . .”

Here’s a bit more context on how this could help with your plans to buy a home.

How Mortgage Rates Affect Your Search for a Home

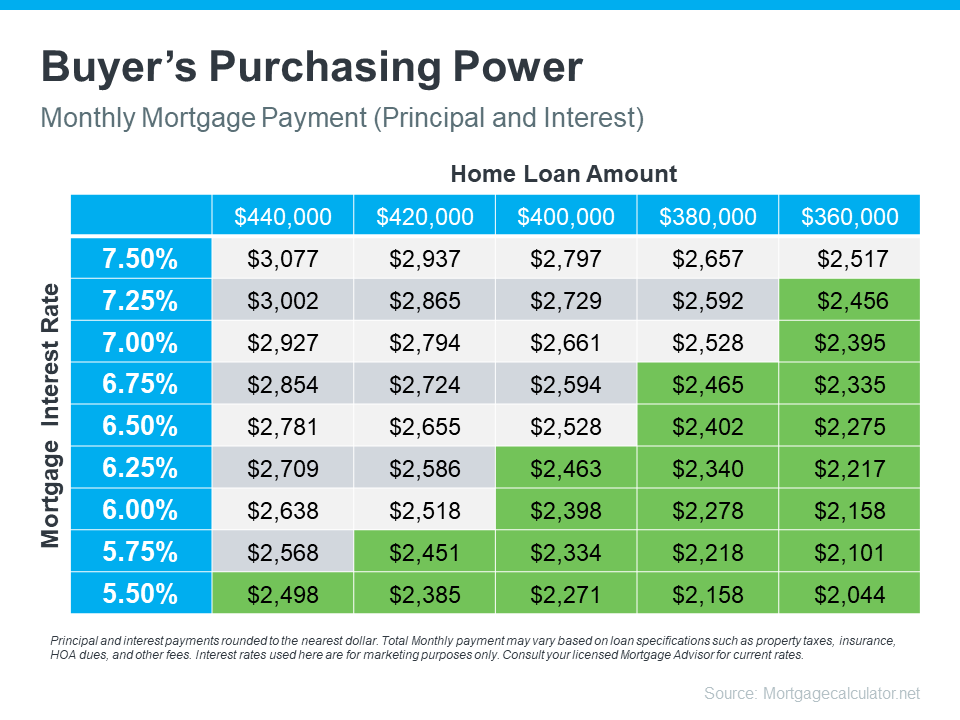

Understanding the connection between mortgage rates and your monthly home payment is crucial for your plans to become a homeowner. The chart below illustrates how your ability to afford a home changes when mortgage rates shift. Imagine your budget allows for a monthly payment between $2,400 and $2,500. The green part in the chart shows payments in that range or lower (see chart below):

As you can see, even small changes in rates can affect your budget and the loan amount you can afford.

Get Help from Reliable Experts To Understand Your Budget and Plan Ahead

When you’re looking to buy a home, it’s important to get guidance from a local real estate agent and a trusted lender. They can help you explore different mortgage options, understand what makes mortgage rates go up or down, and how those changes impact you.

By looking at the numbers and the latest data together, then adjusting your strategy based on today’s rates, you’ll be better prepared and ready to buy a home.

Bottom Line

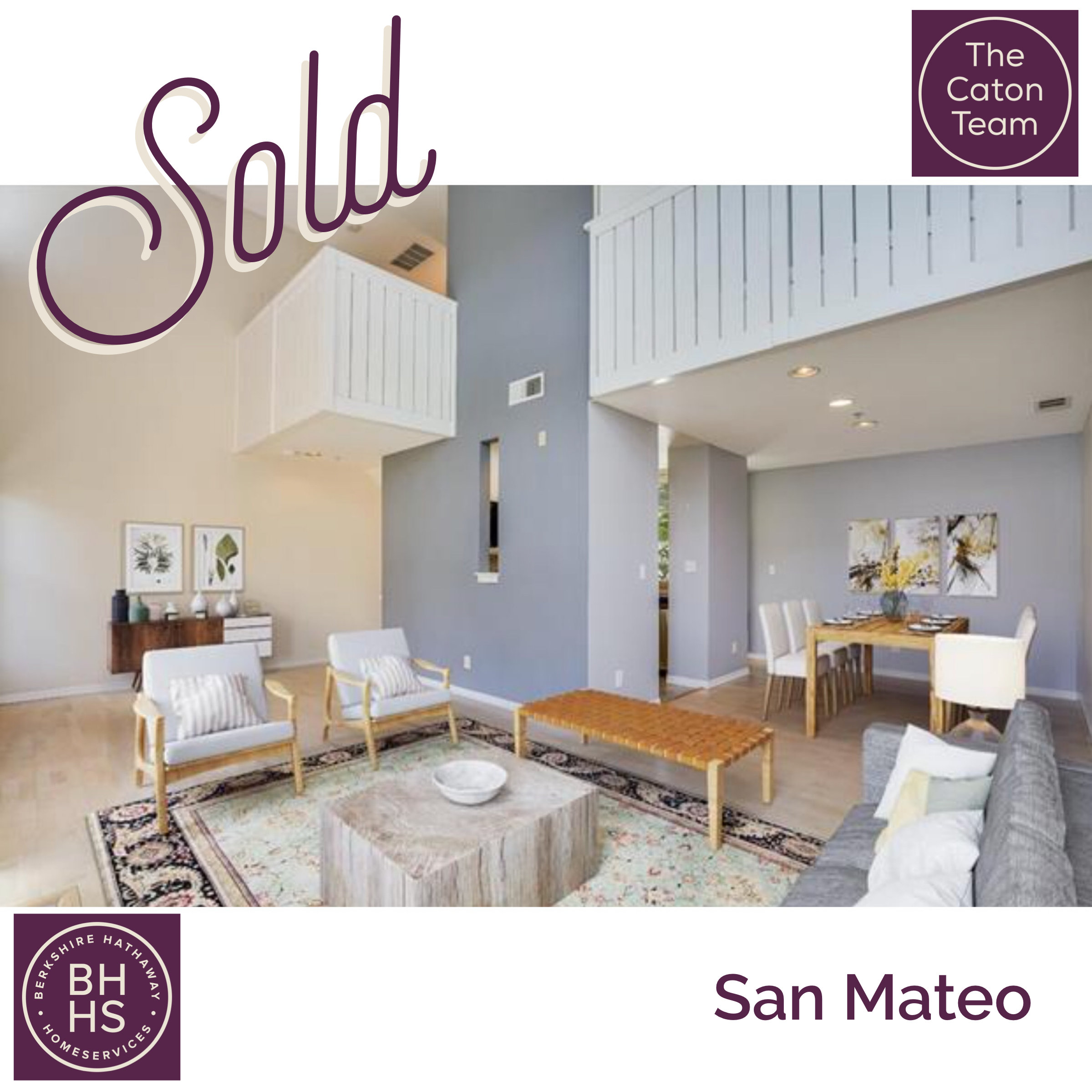

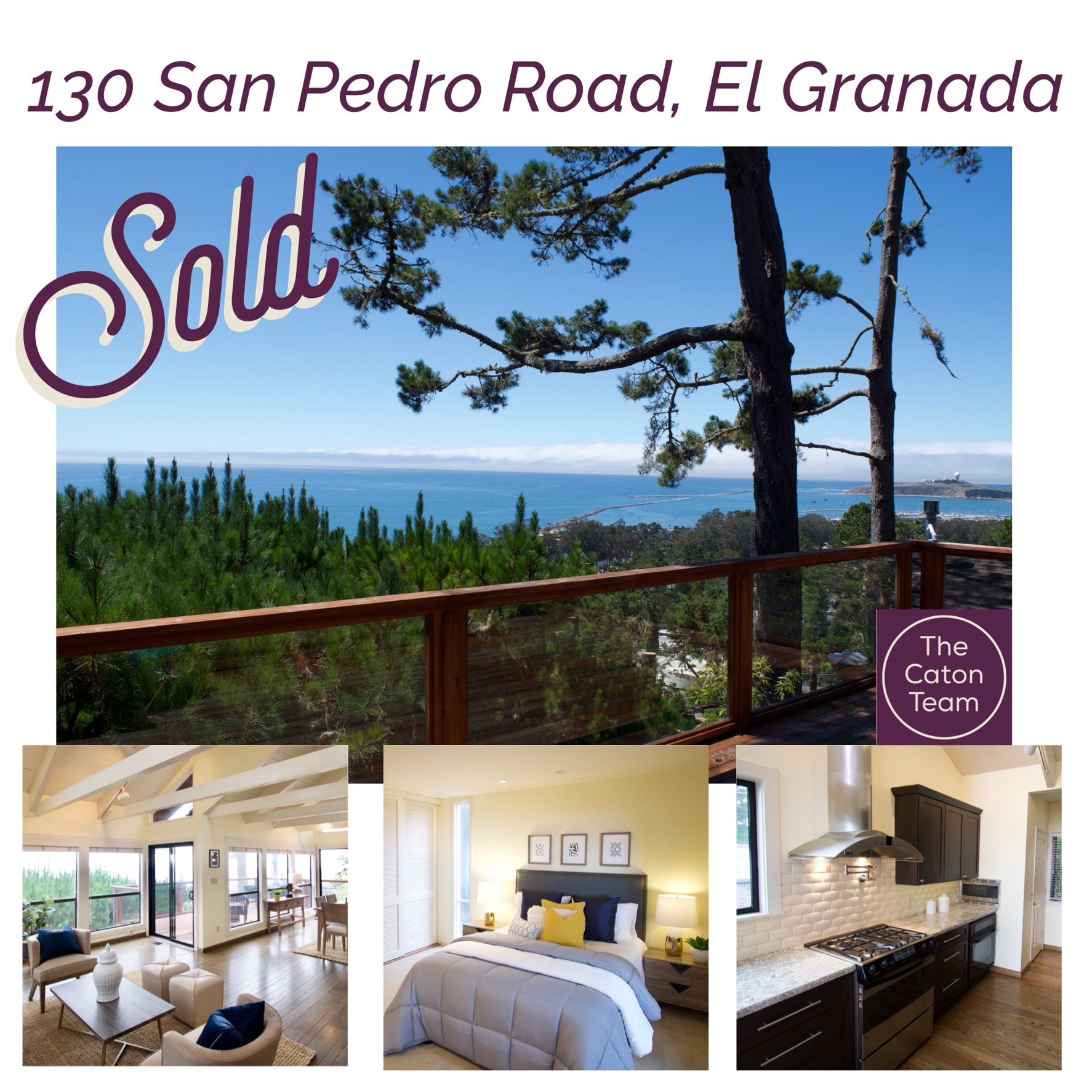

If you’re looking to buy a home, you should know the recent downward trend in mortgage rates is good news for your move. Team up with The Caton Team – with over 45 years of combined, local Real Estate experience – we are here to help you achieve your Real Estate Goals!

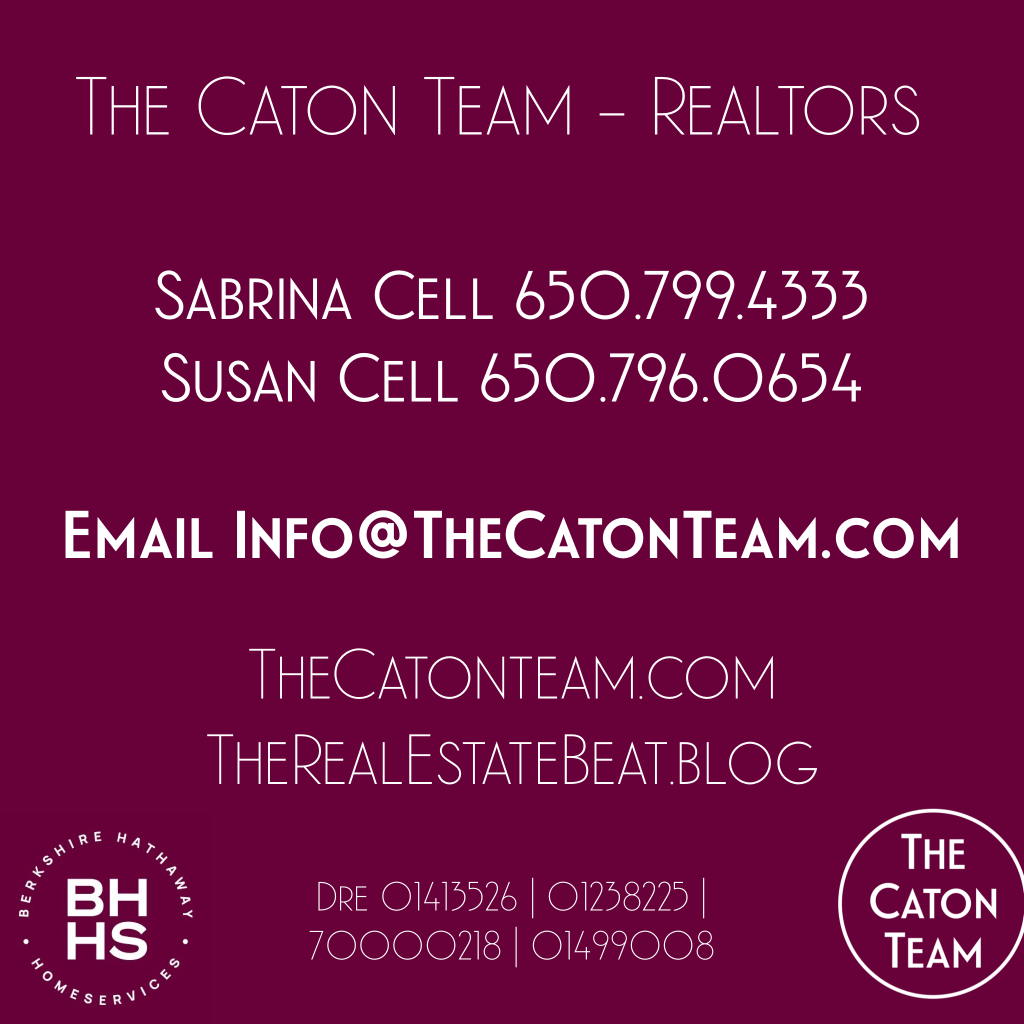

Got Questions? The Caton Team is here to help.

Call | Text | Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB | BLOG

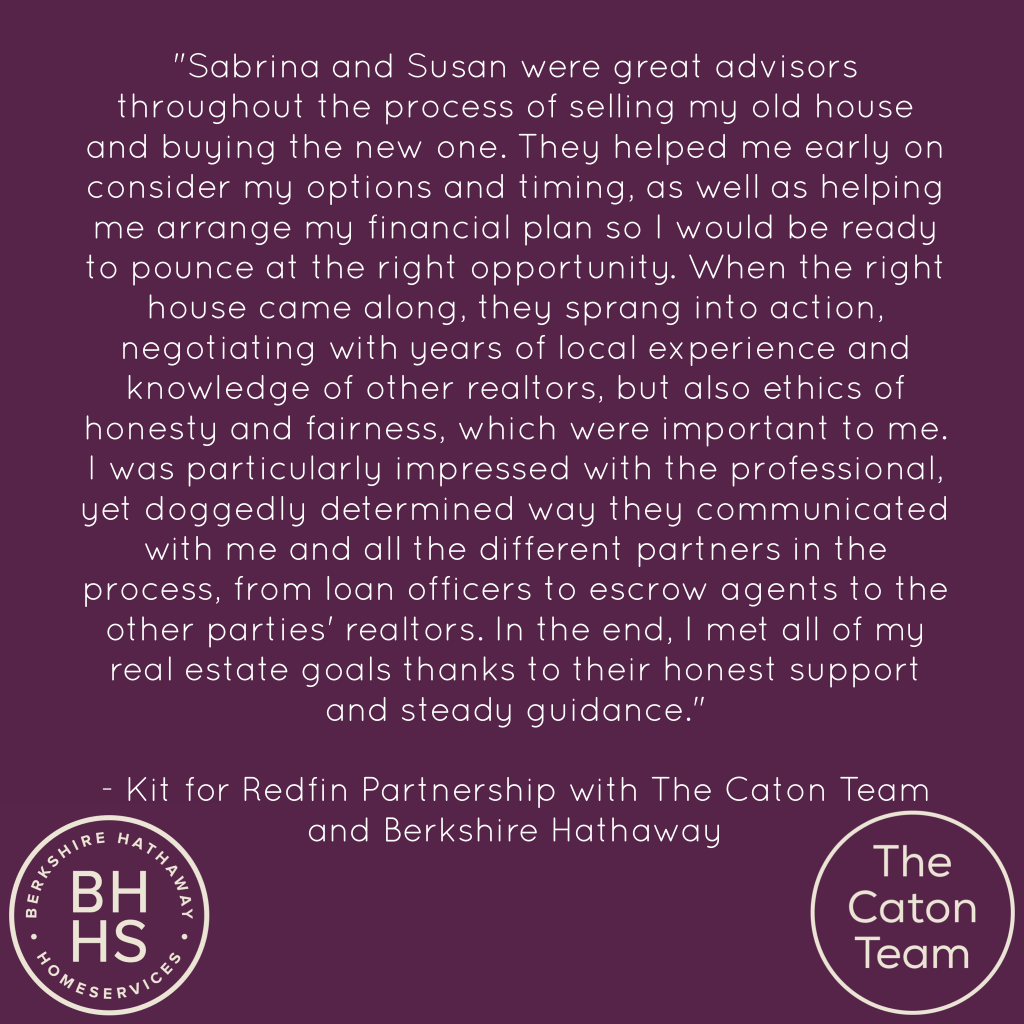

We love what we do and would love to help you navigate your sale or purchase of Residential Real Estate. Please reach out for a personal consultation. Please enjoy our free resources below and get to know our team from our TESTIMONIALS.

Effective. Efficient. Responsive. The Caton Team 🏡 How can The Caton Team help You?

HOW TO BUY | HOW TO SELL | MOVING TIPS | VIRTUAL STAGING |

Get exclusive inside access when you follow us on Facebook & Instagram

TESTIMONIALS| HOW TO SELL | GET READY CAPITAL – Loans to Prep for Sale | VIRTUAL STAGING | A GUIDE TO BUYING | BUYING INFO | MOVING | TRUST AGREEMENTS | HEALTH CARE DIRECTIVES | TESTIMONIALS |

Got Real Estate Questions? The Caton Team is here to help.

We strive to be more than just Realtors – we are also your home resource. If you have any real estate questions, concerns, need a referral, or some guidance – we are here for you. Contact us at your convenience – we are but a call, text or click away!

The Caton Team believes, in order to be successful in the San Fransisco | Peninsula | Bay Area | Silicon Valley Real Estate Market we have to think and act differently. We do this by positioning our clients in the strongest light, representing them with the utmost integrity, while strategically maneuvering through negotiations and contracts. Together we make dreams come true.

A mother and daughter-in-law team with over 35 years of combined, local Real Estate experience and knowledge – wouldn’t you like The Caton Team to represent you? Let us know how we can be of service. Contact us any time.

Call | Text | Sabrina 650.799.4333 | Susan 650.796.0654 | EMAIL | WEB| BLOG

The Caton Team – Susan & Sabrina

A Family of Realtors

Effective. Efficient. Responsive.

What can we do for you?

Website | The Caton Team Testimonials | Our Blog – The Real Estate Beat | Search for Homes | Facebook | Instagram | HomeSnap | Pinterest | LinkedIn Sabrina | Photography | Photography Blog

Berkshire Hathaway HomeServices – Drysdale Properties, Redwood City Ca.

DRE # | Sabrina 01413526 | Susan 01238225 | Team 70000218 | Office 01499008

The Caton Team does not receive compensation for any posts. Information is deemed reliable but not guaranteed. Third-party information not verified.

You must be logged in to post a comment.